WealthTree

Improving financial literacy and management for young, working women in the United States

Define

Problem Statment

How might we elevate the level of financial literacy and enhance the comprehension of financial management for young, working women in the United States?

My Roles

UX Design: design system, ideation, external brainstorming, storyboard, sketches, wireframes, prototyping, user testing, heuristic evaluations, iteration

UX Research: observations, competitive analysis, survey, interviews, empathy map, research analysis

Tools Used

Figma

Notion

Qualtrics

Project Context

Fall 2023 - Spring 2024

Team:

Adviti Atluri, UX Researcher

Druti Naik, UX Researcher

Dr. Carrie Bruce, Process Advisor

Dr. Whitney Buser, Subject Matter Expert

Primary Users

Women aged 18-30, varying socioeconomic and educational backgrounds, early in their career or financial journey, and planning for the future

Research

Overview

11 Literature Reviews

6 Exploratory Interviews

1 Subject Matter Expert Input

11 Resources Compared In-Depth

2 Observation Sessions

79 Respondent Survey

11 Semi-Structured Interviews

Research Analysis

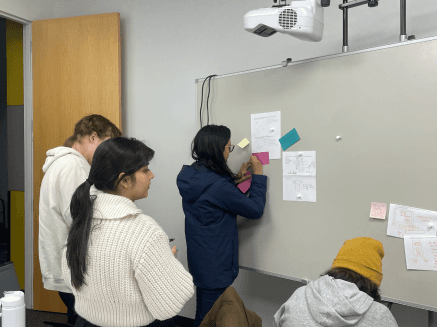

We synthesized data from user interviews through affinity mapping. We ended up with 335 sticky notes from our interpretation session.

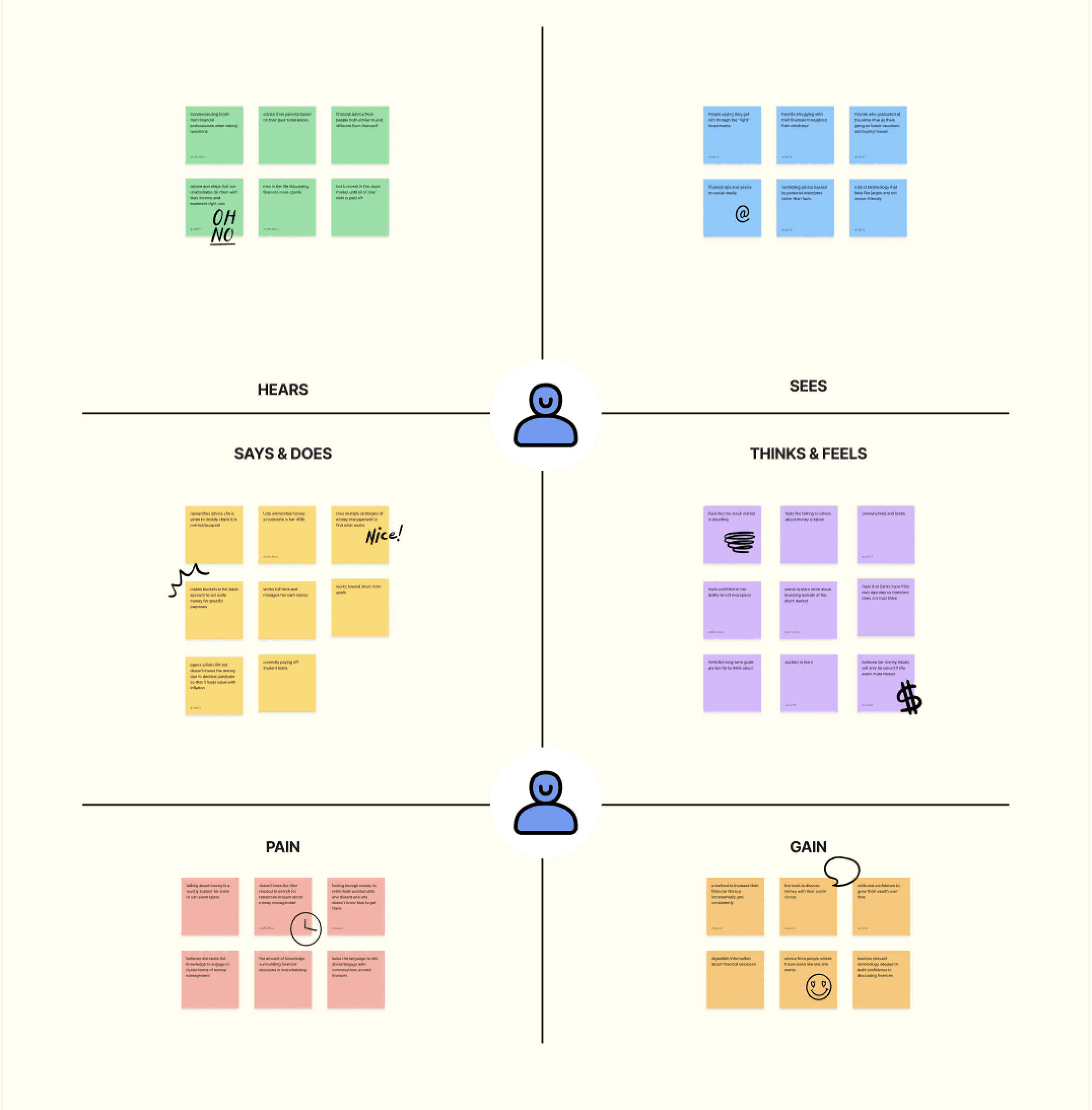

By visualizing our user’s thoughts, feelings, actions, and observations through an empathy map, we were able to pull out pain points and areas of opportunity.

Knowledge

Pain: Lacking knowledge including terms and languages to engage in certain practices

Gain: Digestible information about financial decisions and terms

Time

Pain: Not enough time needed to search for resources to learn about money management

Gain: A central hub to increase their financial literacy incrementally and consistently

Resources

Pain: Having enough money to retire feels unattainable and distant

Gain: Skills and confidence to grow their wealth over time; need to visualize what saving for retirement looks like

Key Insights

Confidence through Research & Terminology

Women feel more confident about their financial decisions when they have knowledge, terminology, and a plan

Time is a Barrier to Financial Decision Making

Many participants felt as though they did not have enough time to make smarter financial decisions or to expand their financial knowledge

Low Confidence in Long-Term Goals

Participants felt most confident about their short-term financial decisions and least confident about their long-term financial decisions

Trust in Verified Financial Institutions

Participants trust online sources such as Morningstar, Fidelity, and E-Trade, but these sources vary between participants

Design

Design Requirements

Transforming research insights into design requirements allowed me to begin the design process with clear guidelines.

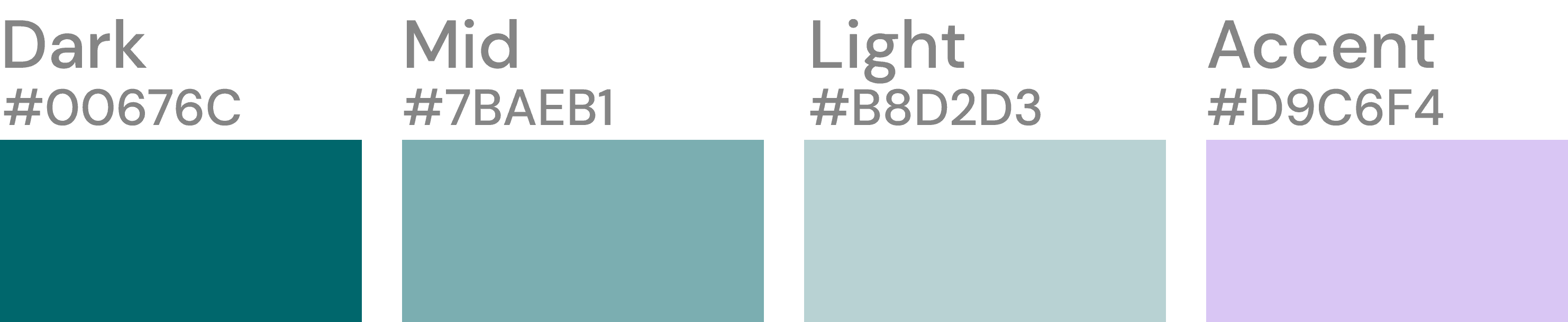

Empowerment through Terminology

Our intervention should be a central resource that empowers users with the terminology needed to feel confident when discussing finances

Brief Lessons

Our intervention should provide brief lessons for people with limited time

Simplify Long-Term Goals

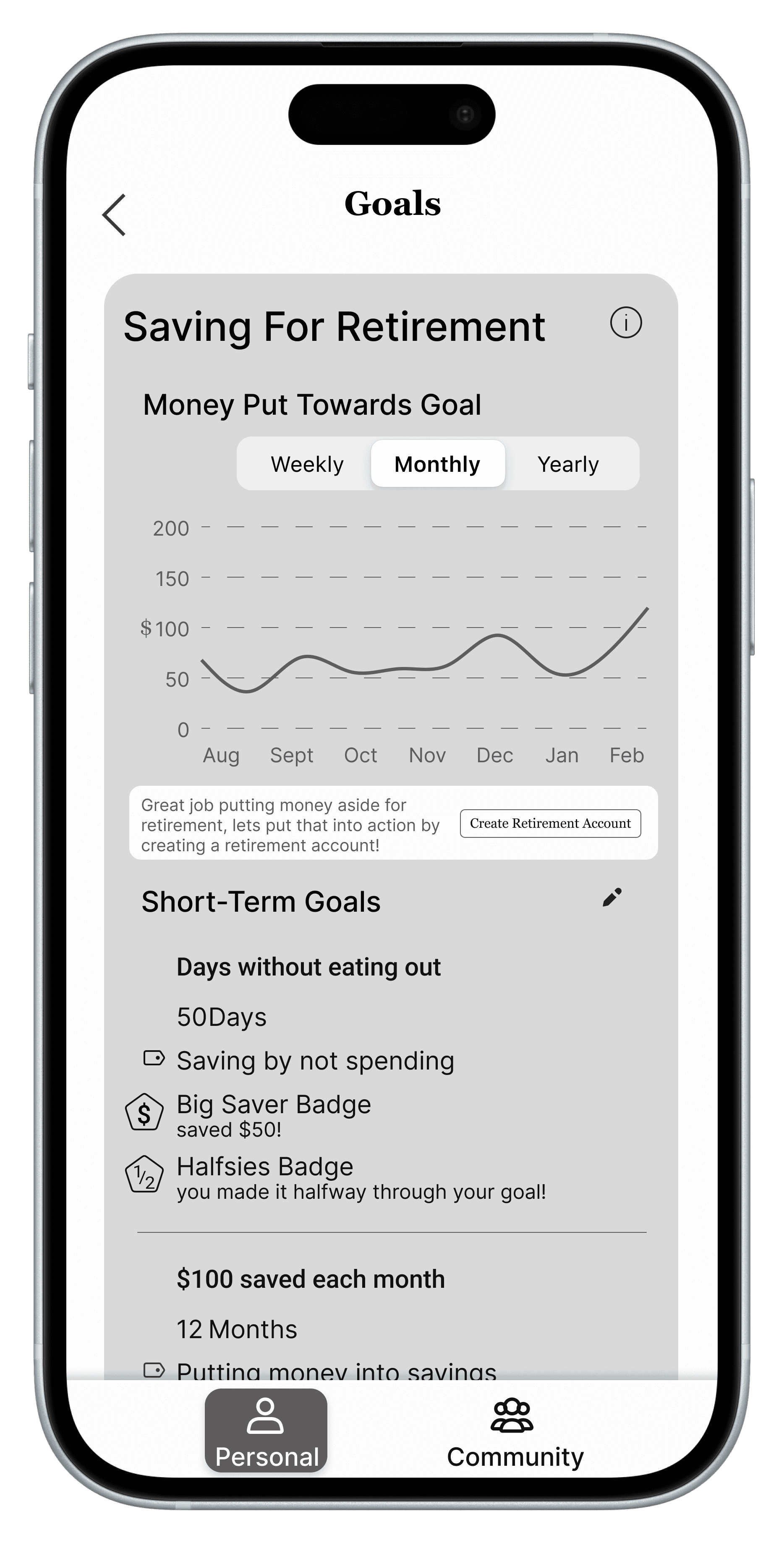

Our intervention should make long-term financial decisions simplified and feel more attainable and short-term goals should be emphasized

Custom Information

Our intervention should be customizable depending on our users’ informational wants and needs

Brainstorming

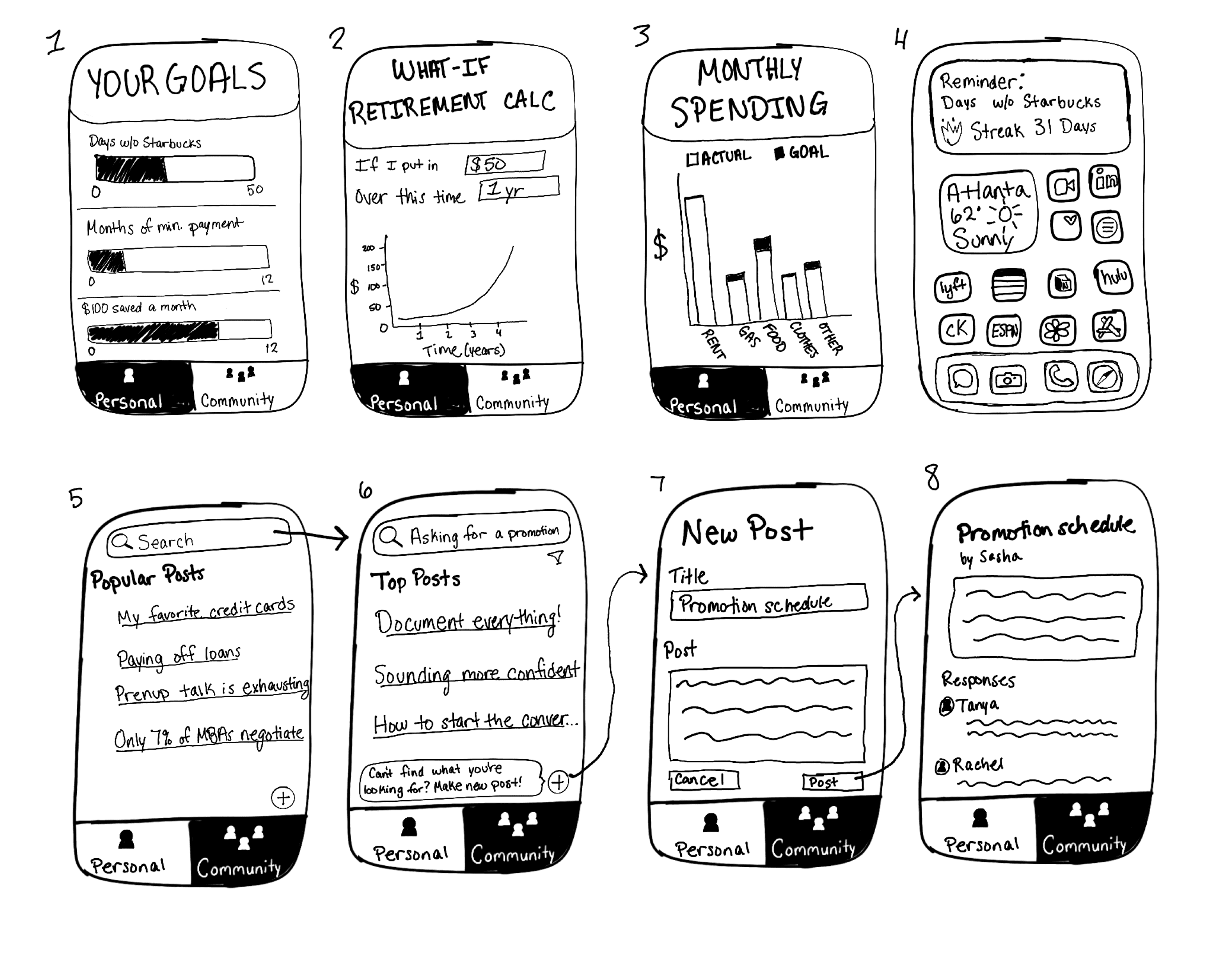

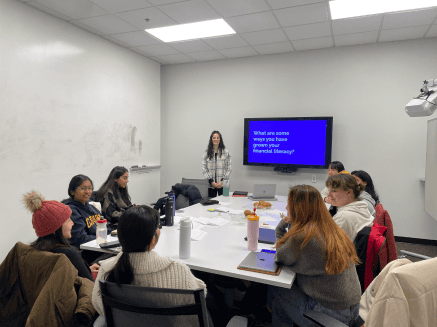

My group and I conducted crazy 8 brainstorming internally and later, I led 8 participants in external brainstorming.

Ideas were compiled, comparing them against research findings, design requirements, feasibility of time, and development skills.

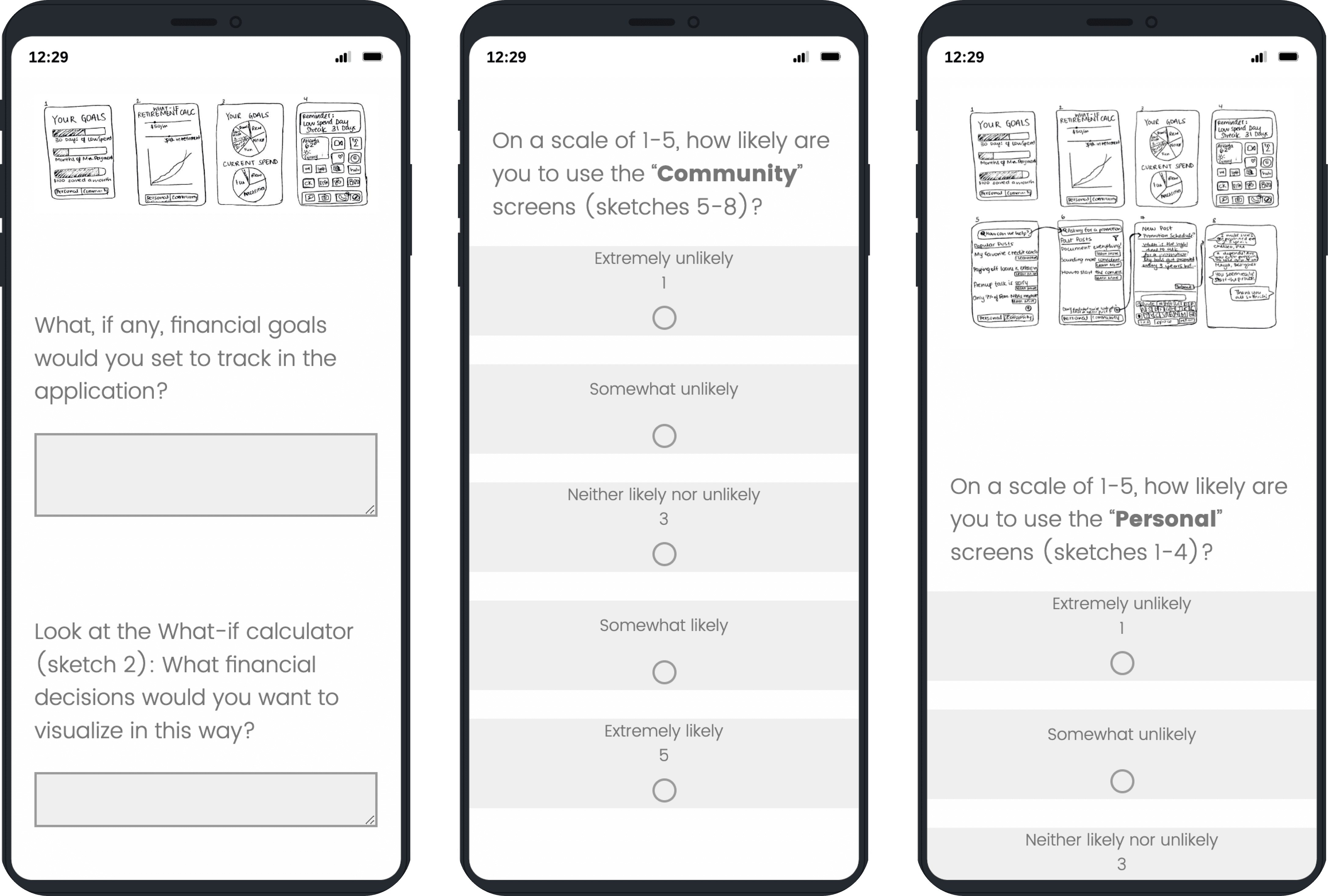

Sketches

Sketch Feedback

We surveyed 22 MS-HCI students and acquaintances within our target demographic.

Key Insights

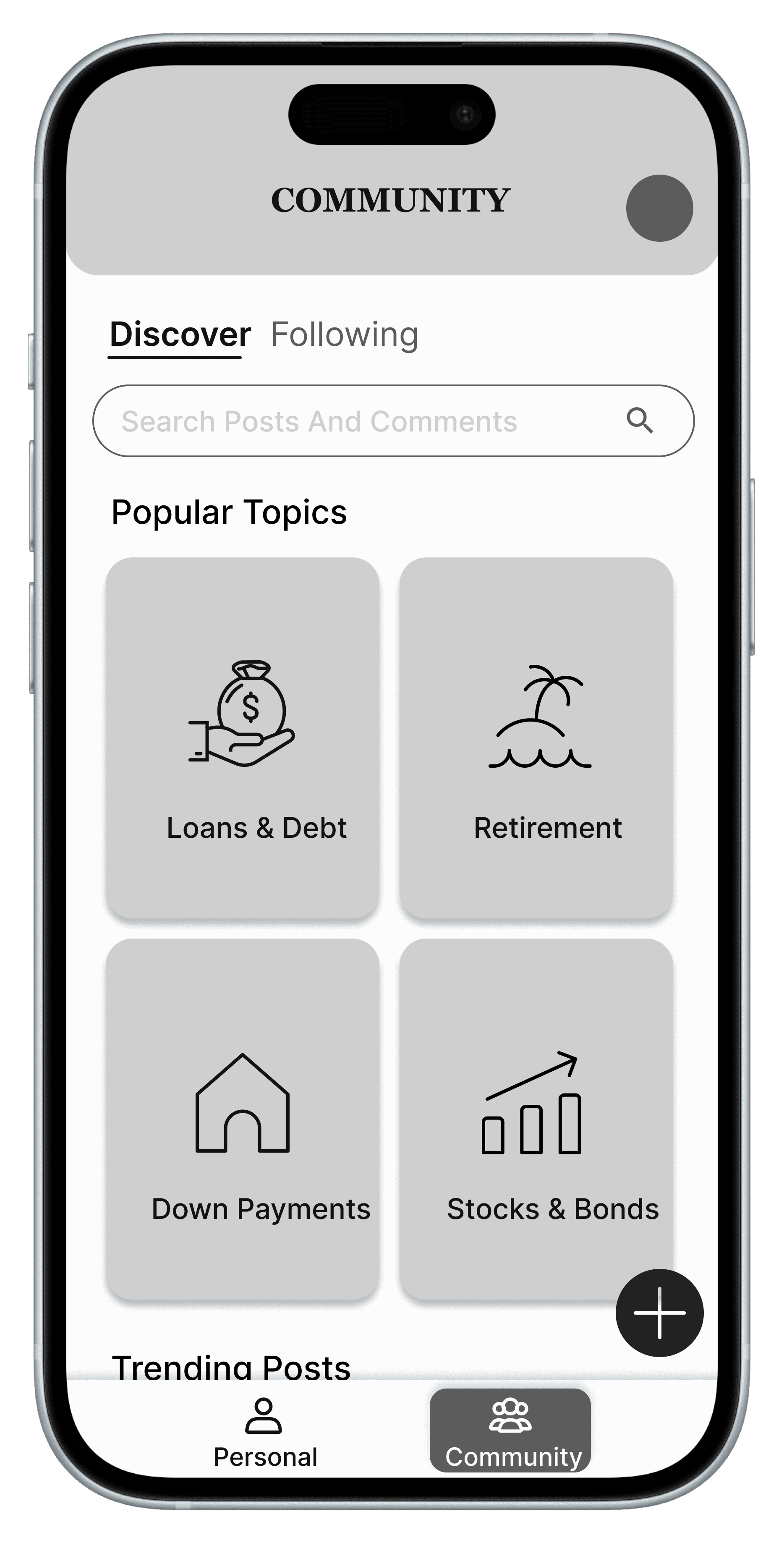

Personal and Community Aspects

Most users said they were likely to use both the personal and community pages

Not-so-popular 'Popular Posts'

Almost half of the users voted popular posts as the least useful feature

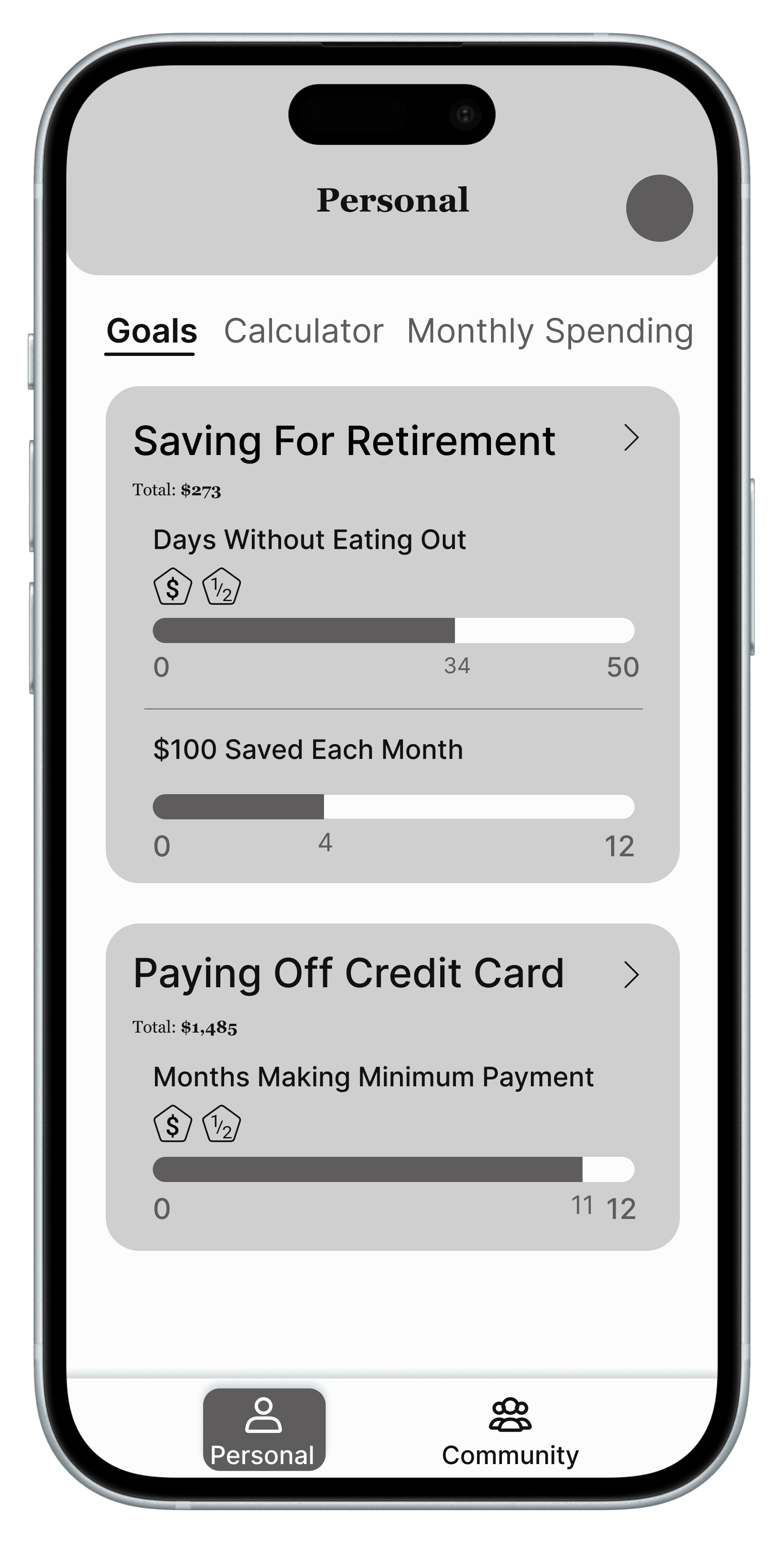

Envisioning Saving for Retirement

The most frequently cited aspect users envisioned utilizing this product for was saving for retirement

Wireframes

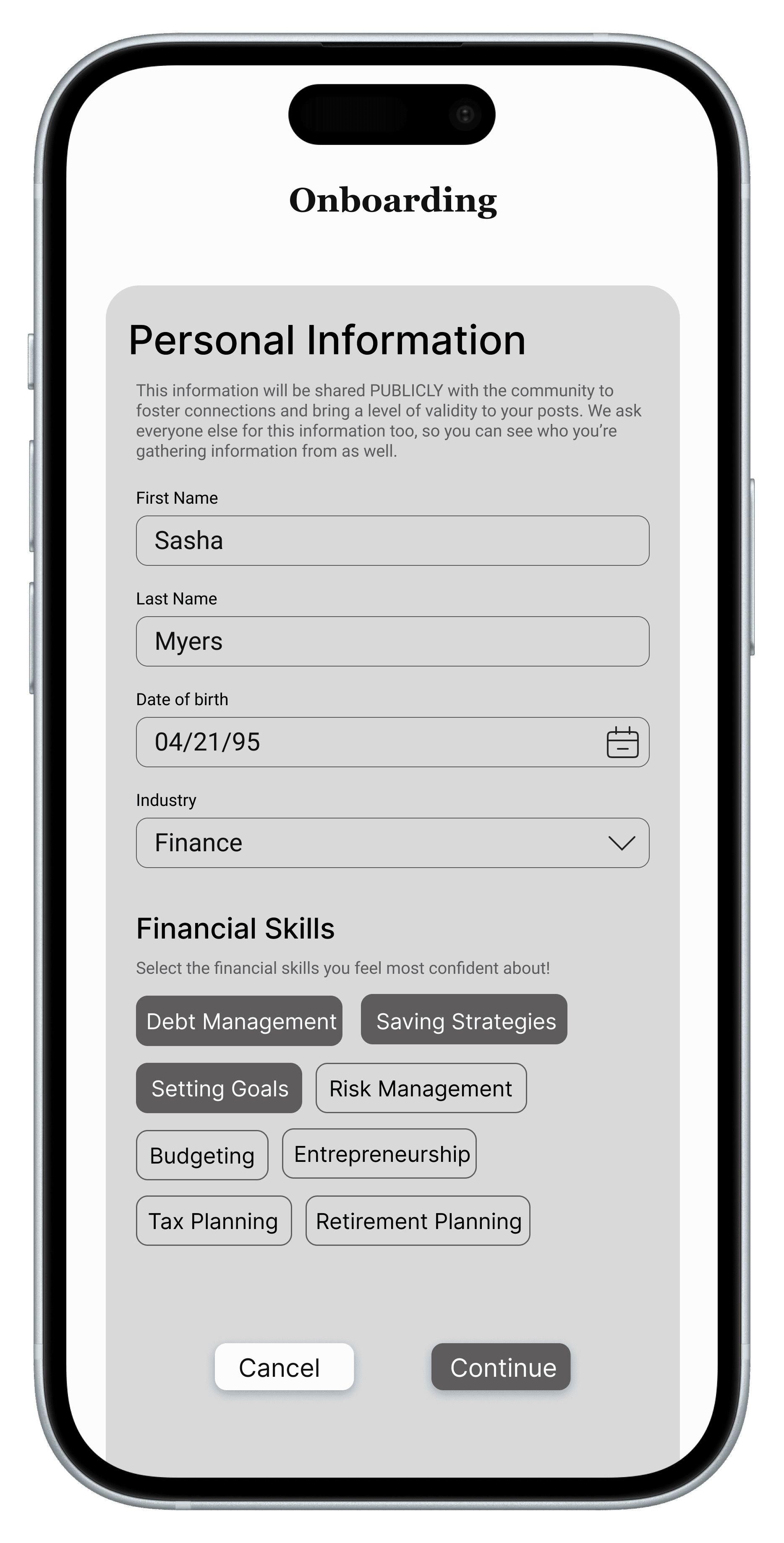

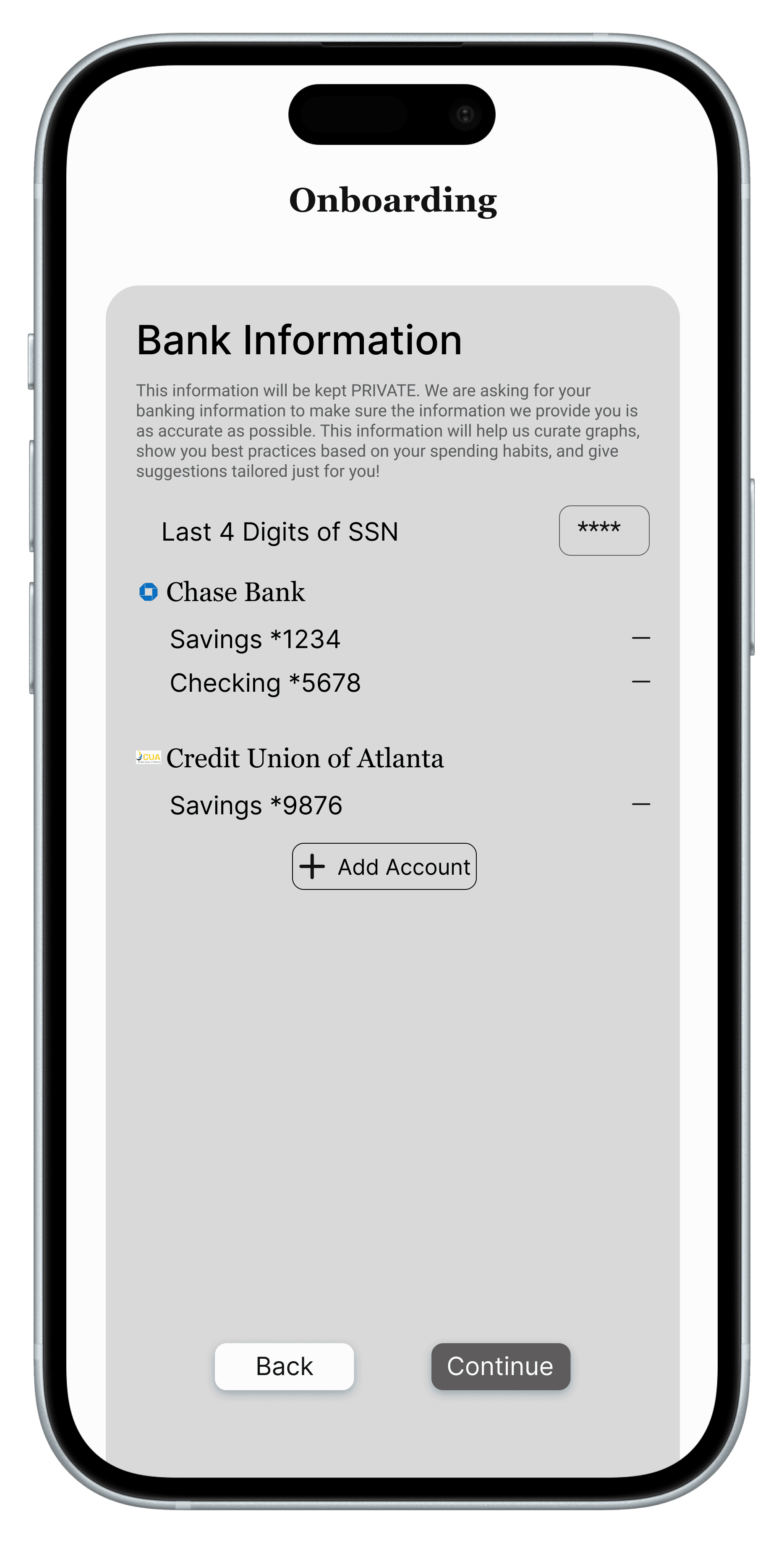

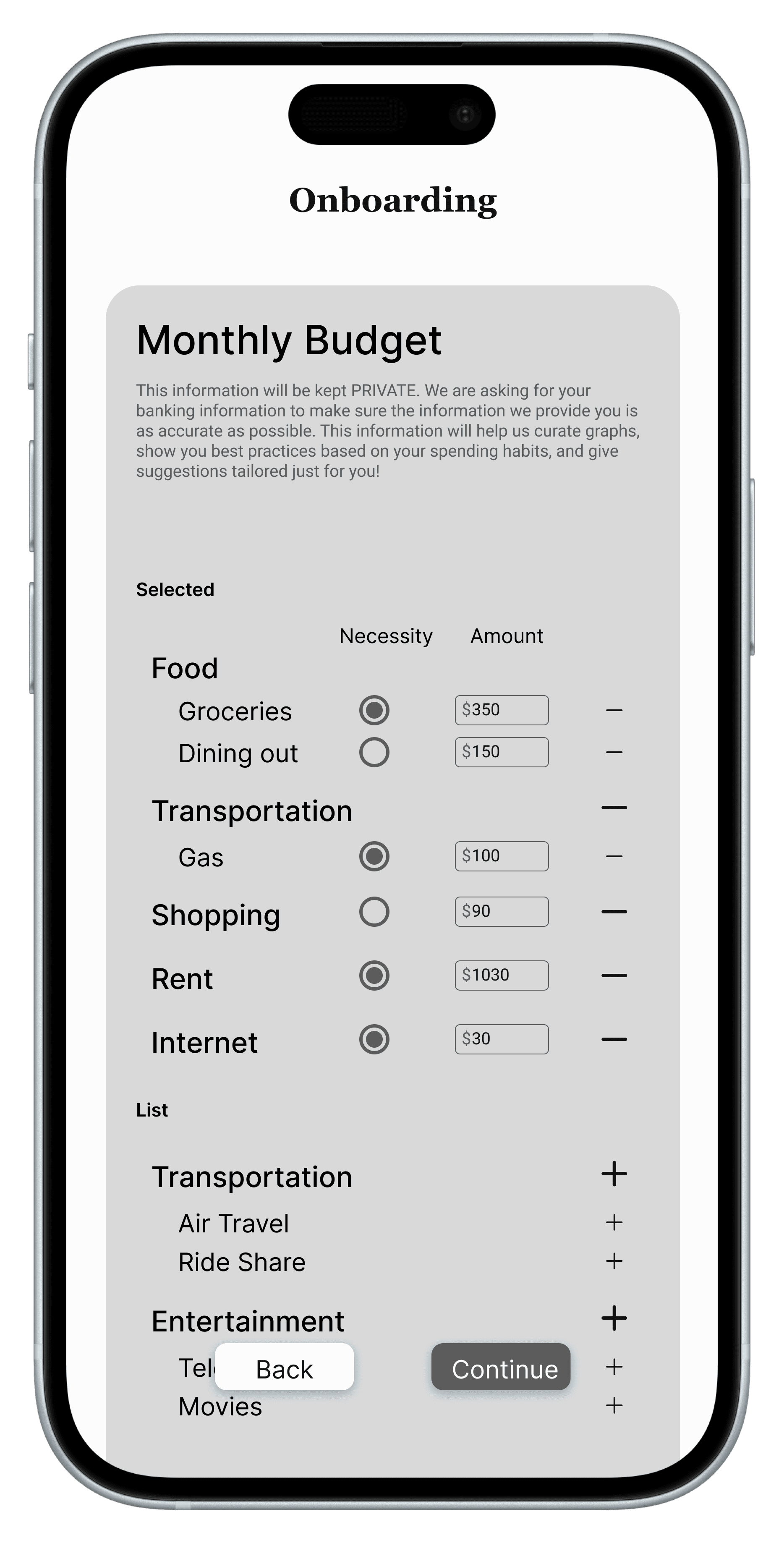

Onboarding

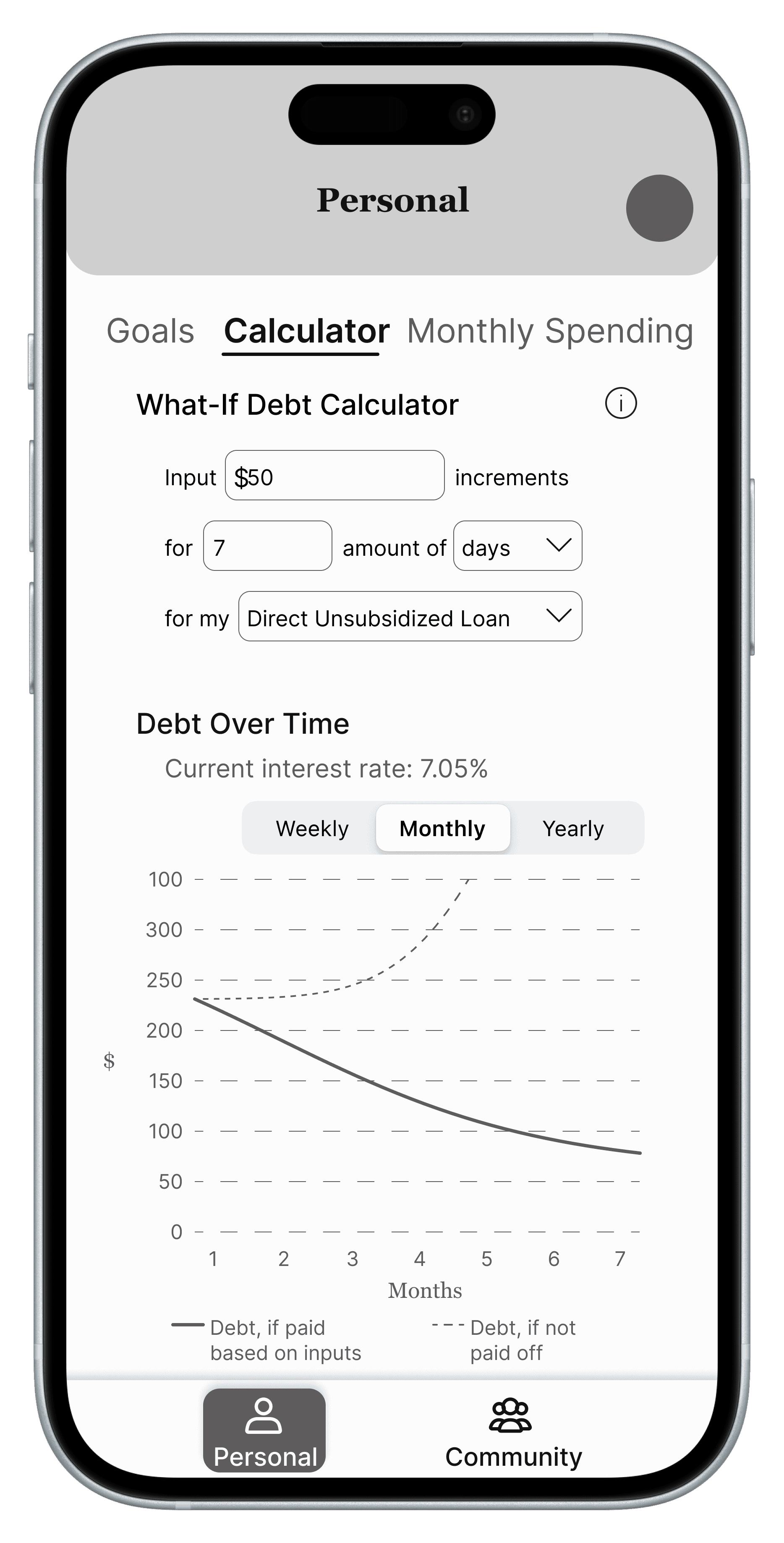

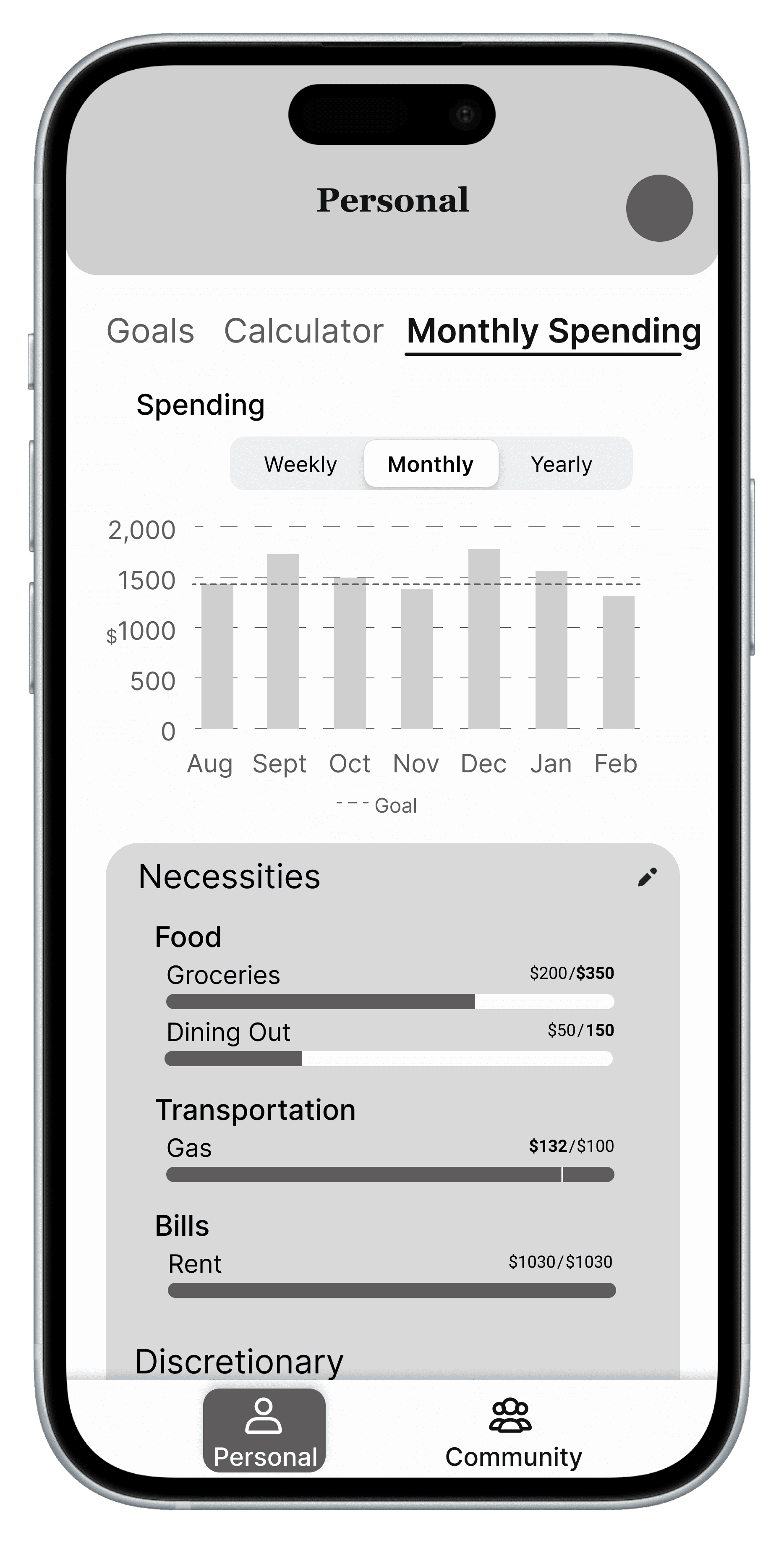

Personal

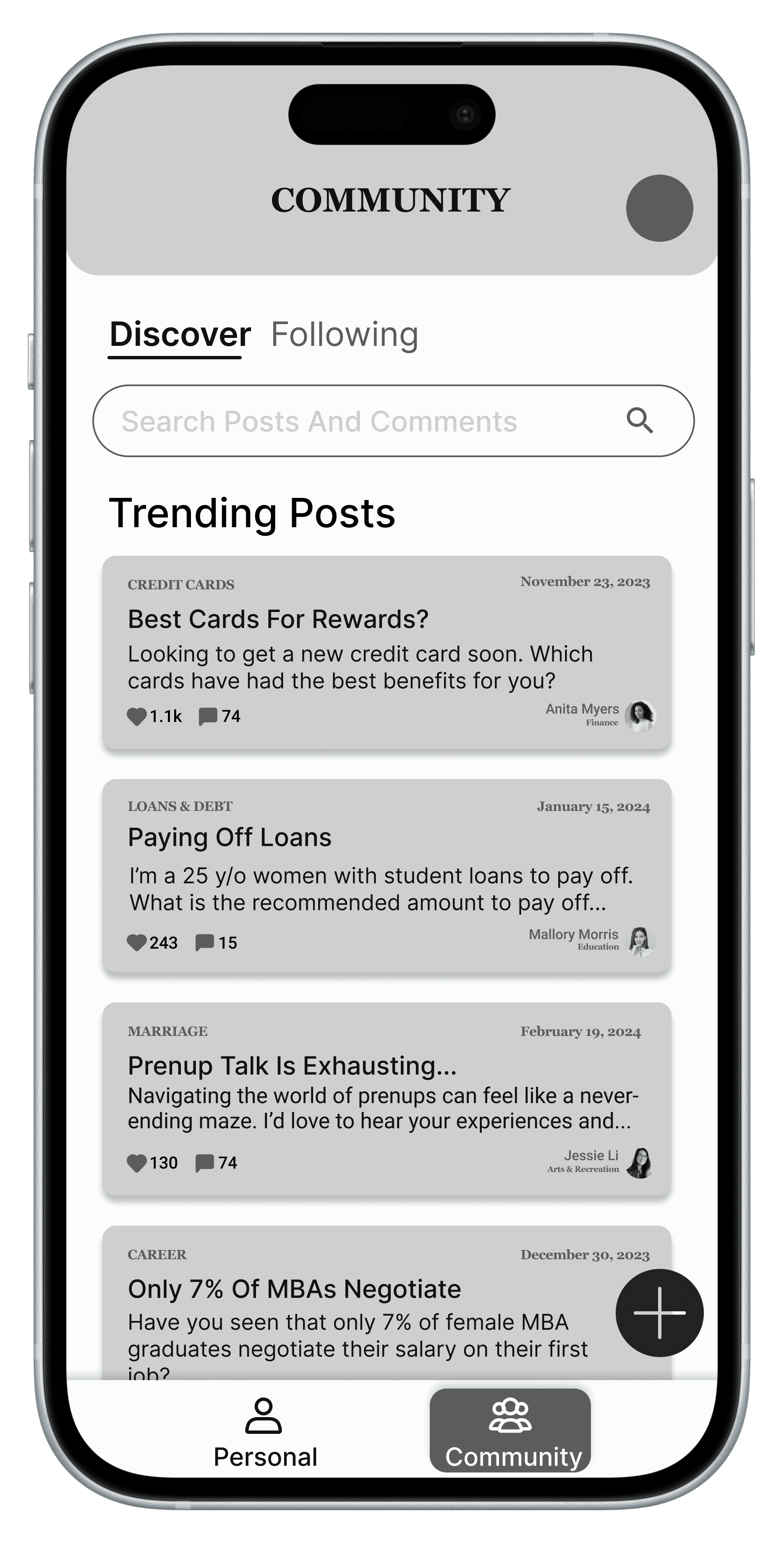

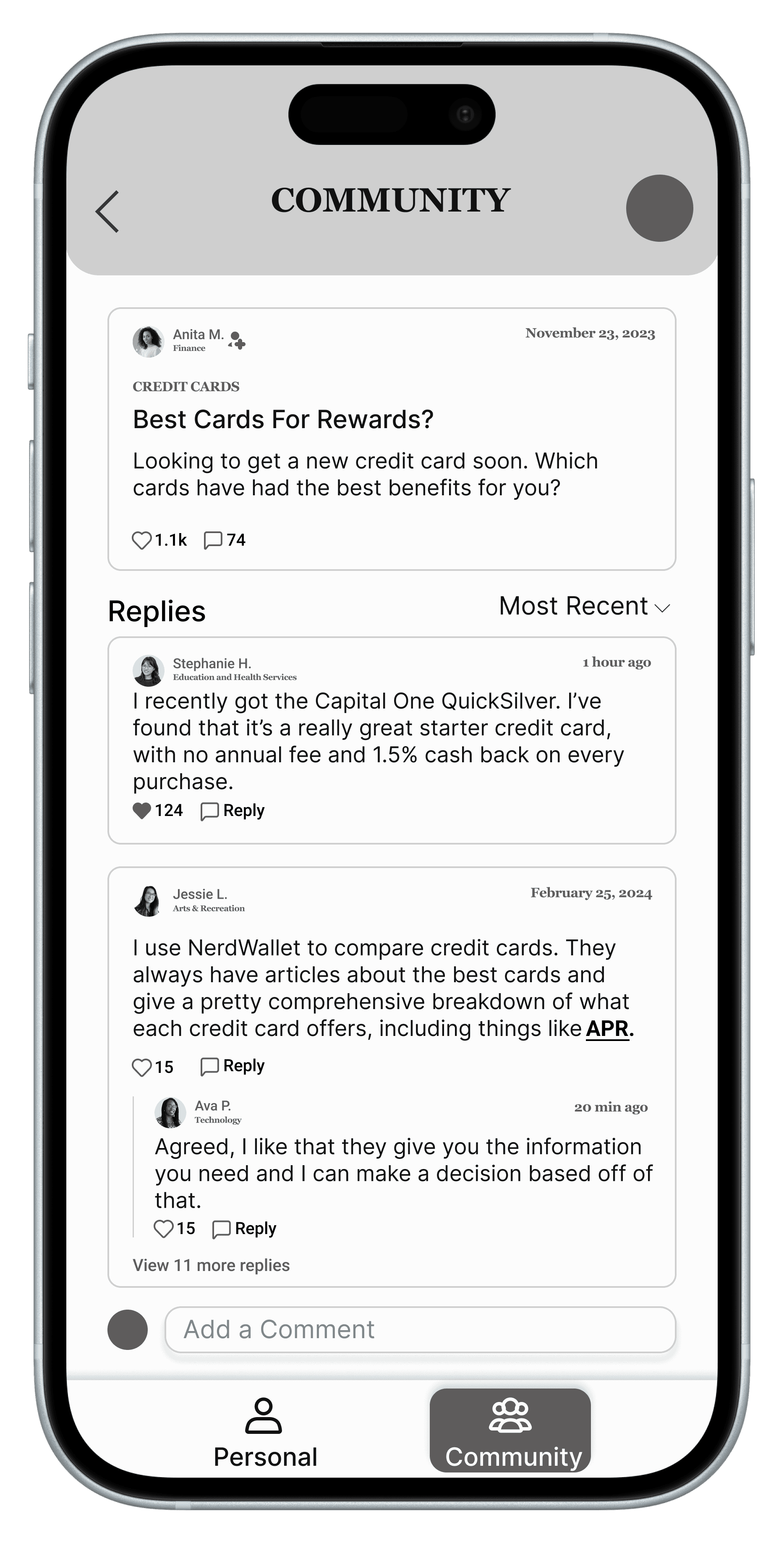

Community

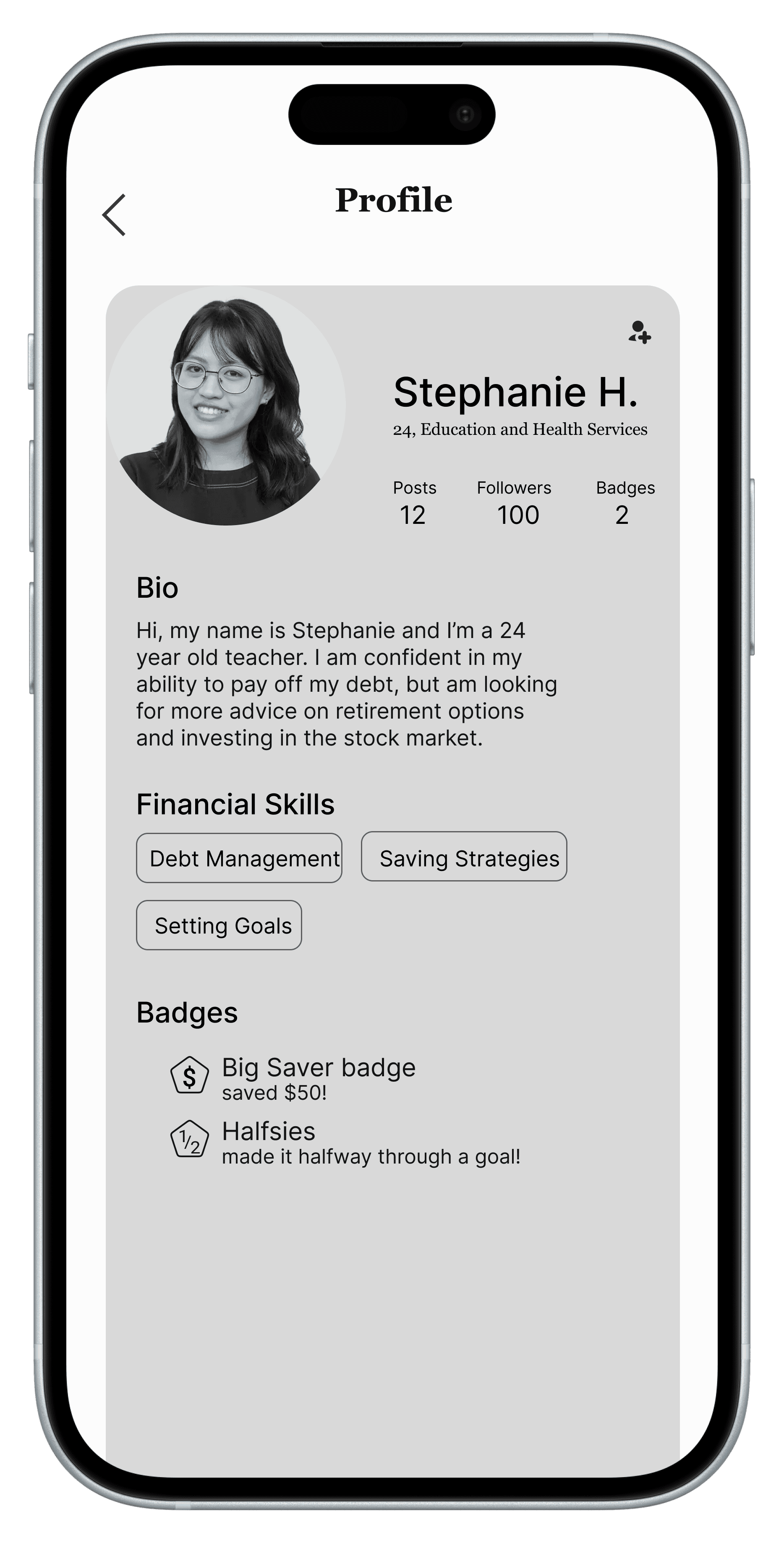

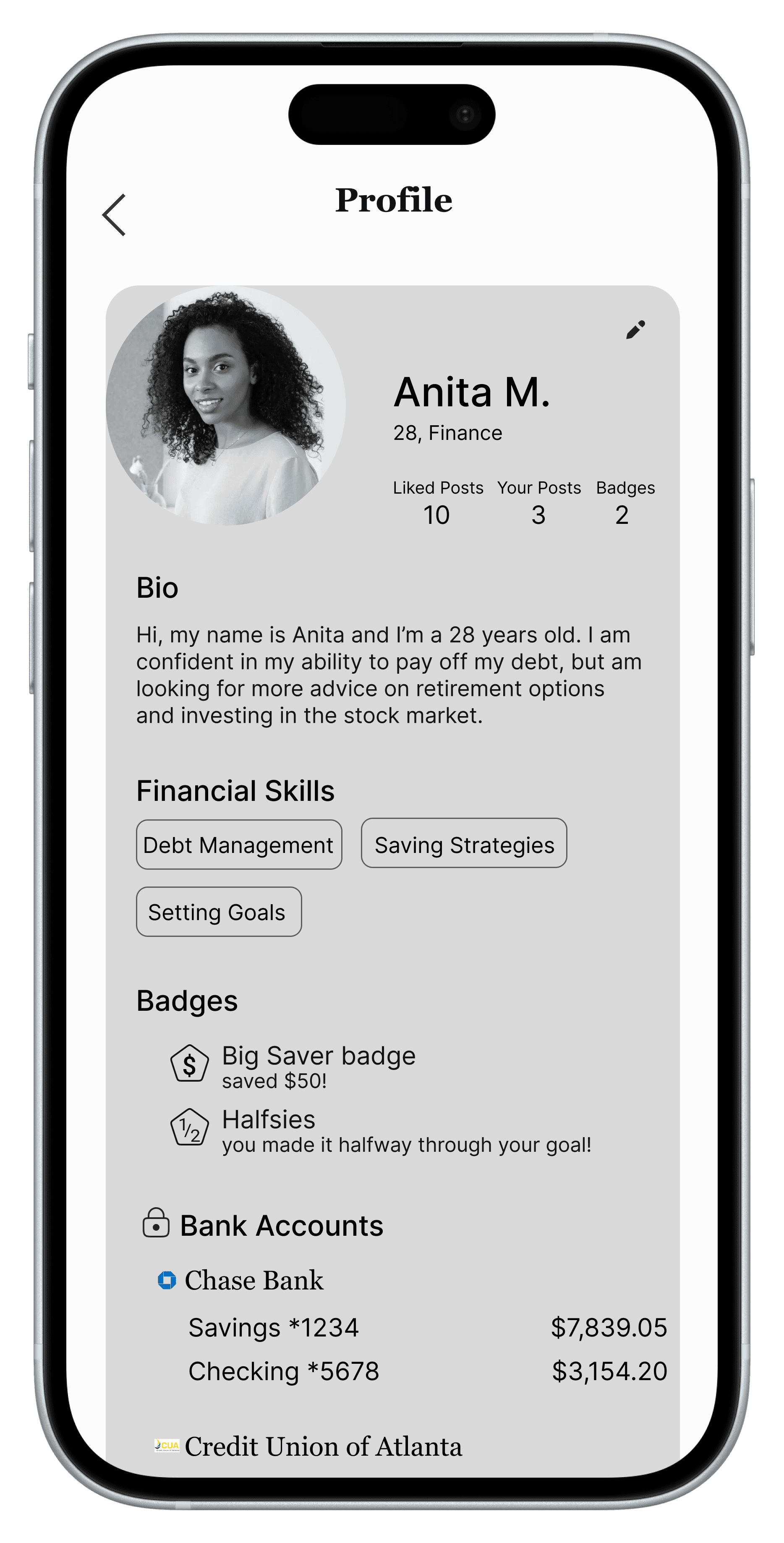

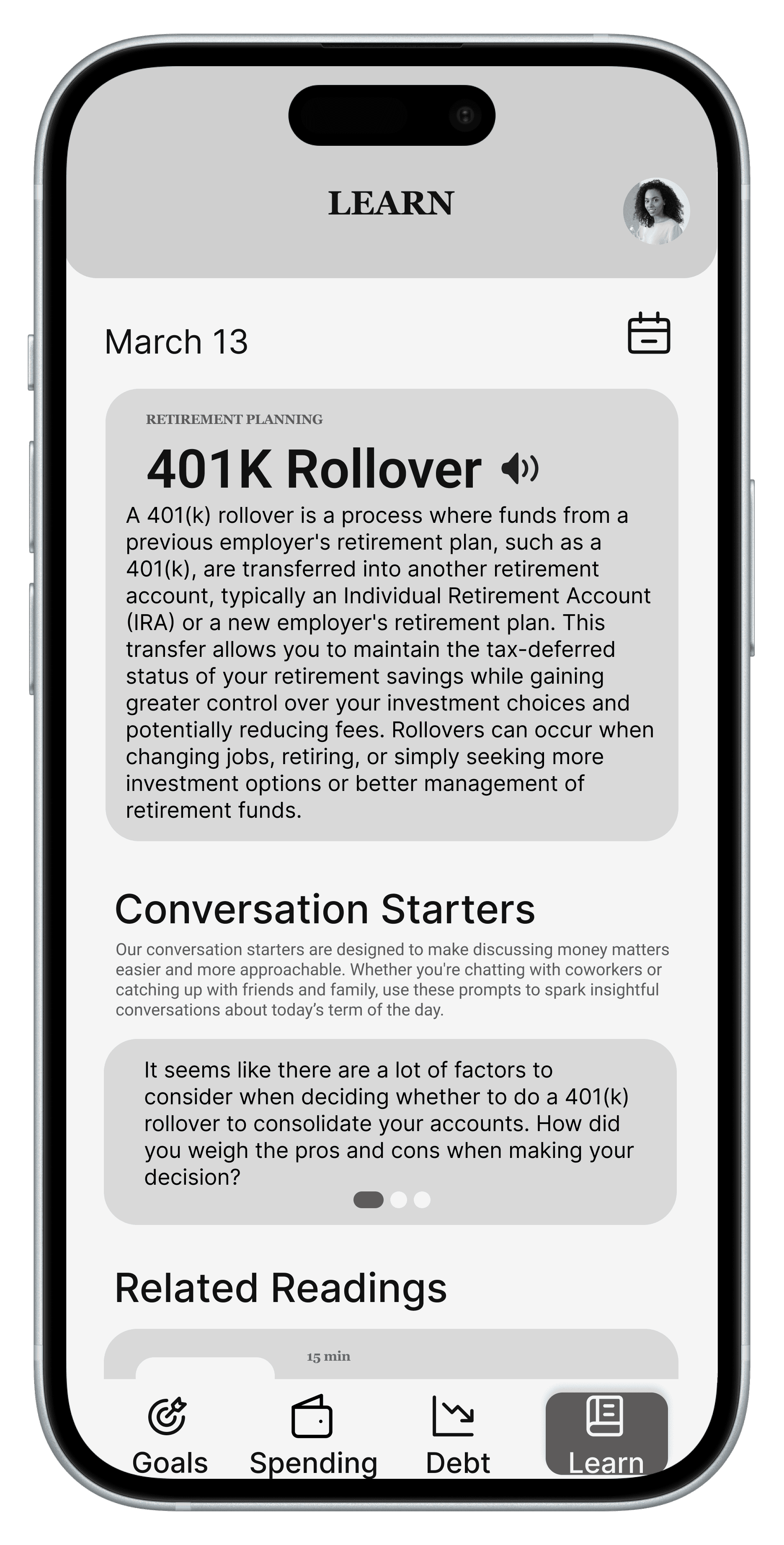

Profile

Wireframe Testing

We tested our mid-fidelity prototype with 8 participants for usability, comprehension, appeal, and balance.

Wireframe Testing Insights

Privacy

Community

The Big Pivot

Based on brainstorming outcomes and wireframe feedback we pivoted part of our solution, swaping the community section with a learn section and got positive feedback on it from the final 2 users.

Since all sections now delt with personal finance management, I placed them in the main navigation bar at the bottom.

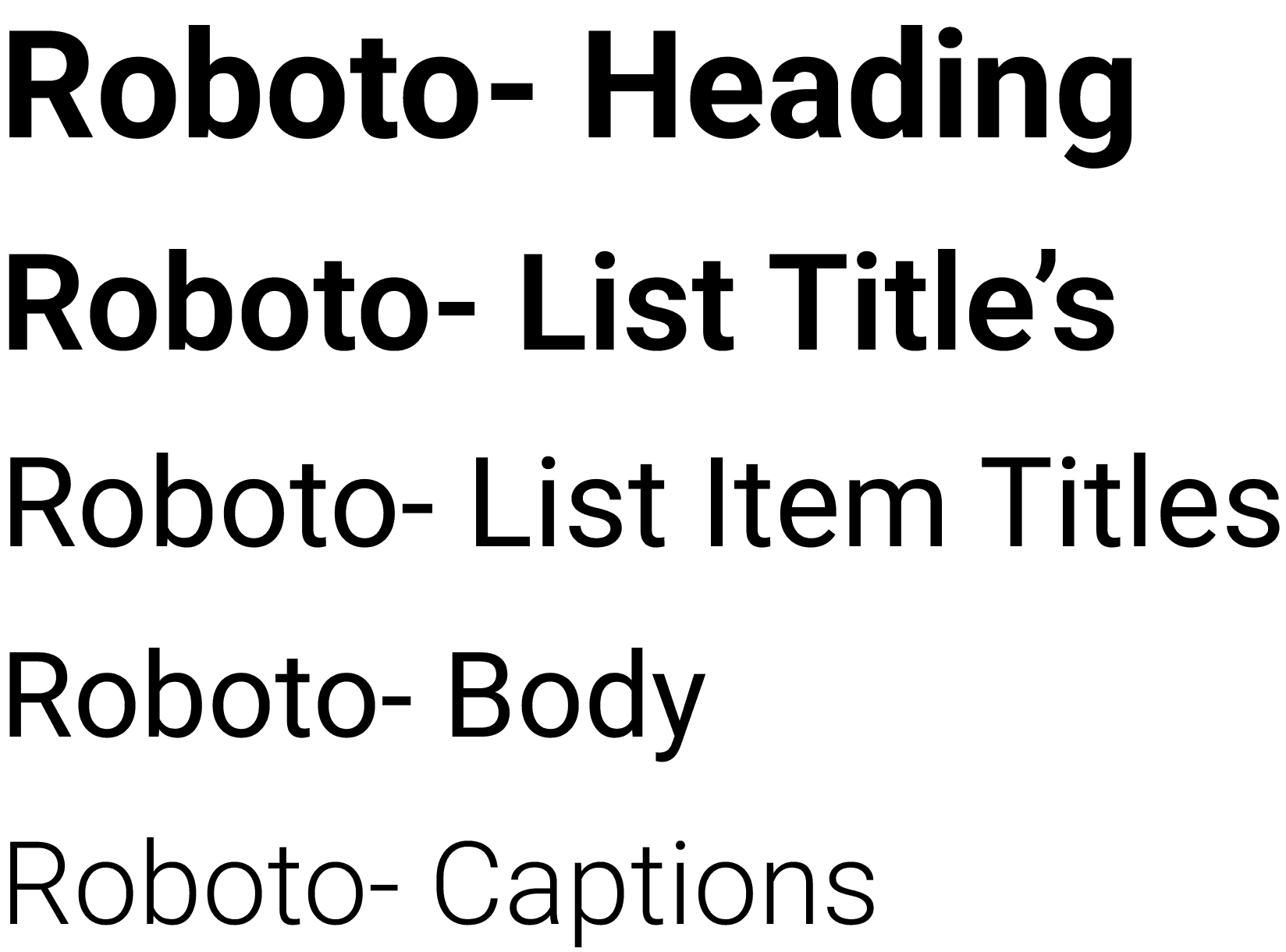

Design System

Five different financial app color palettes were compared; all of them included some shade of green.

Emotions/feelings to convey

Composed/collected

Trust

Empowering

Pleasing/inviting

Color options

Green

Purple

Blue

Pastels

Final Choices

Color Palette

Font

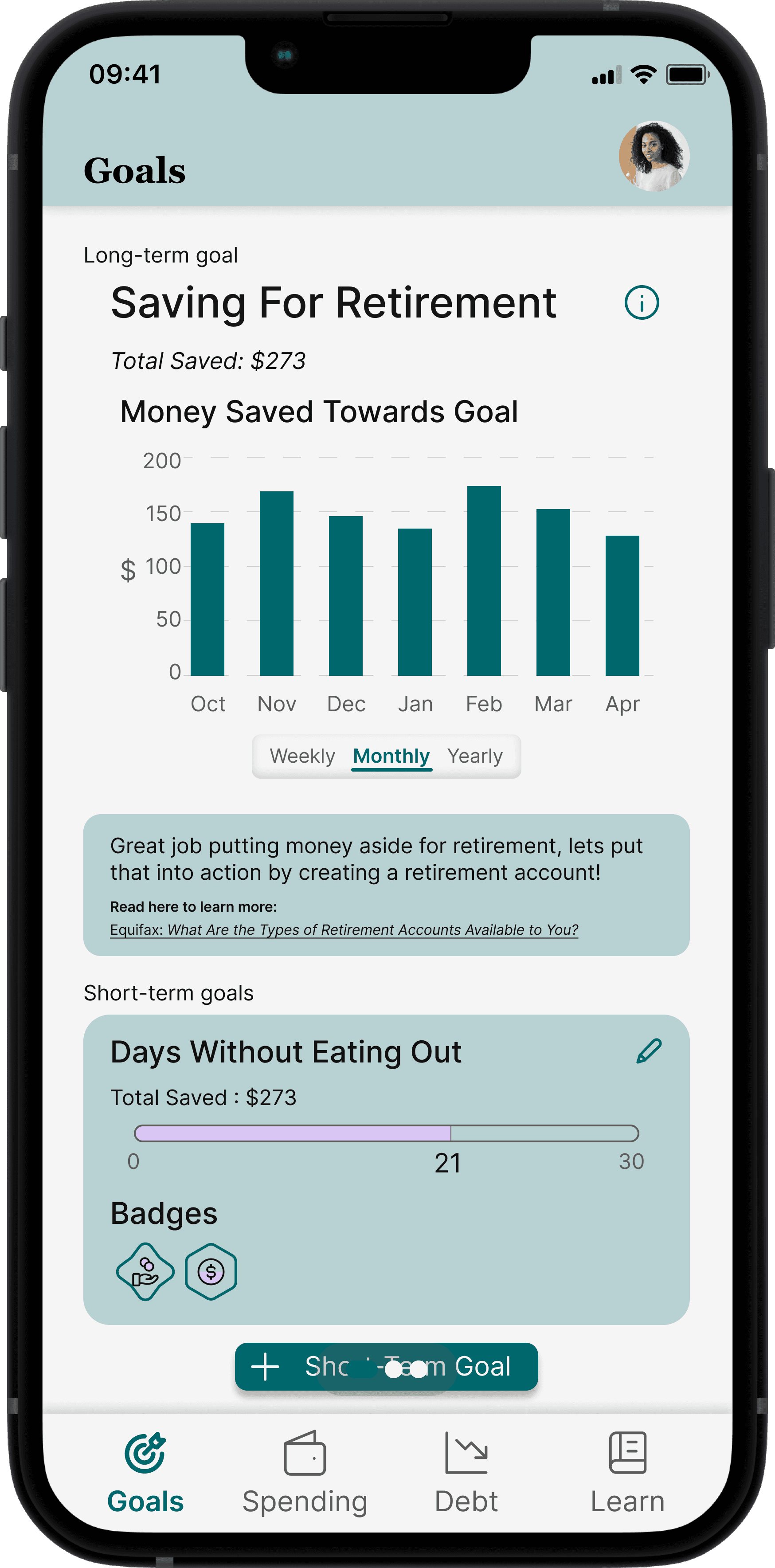

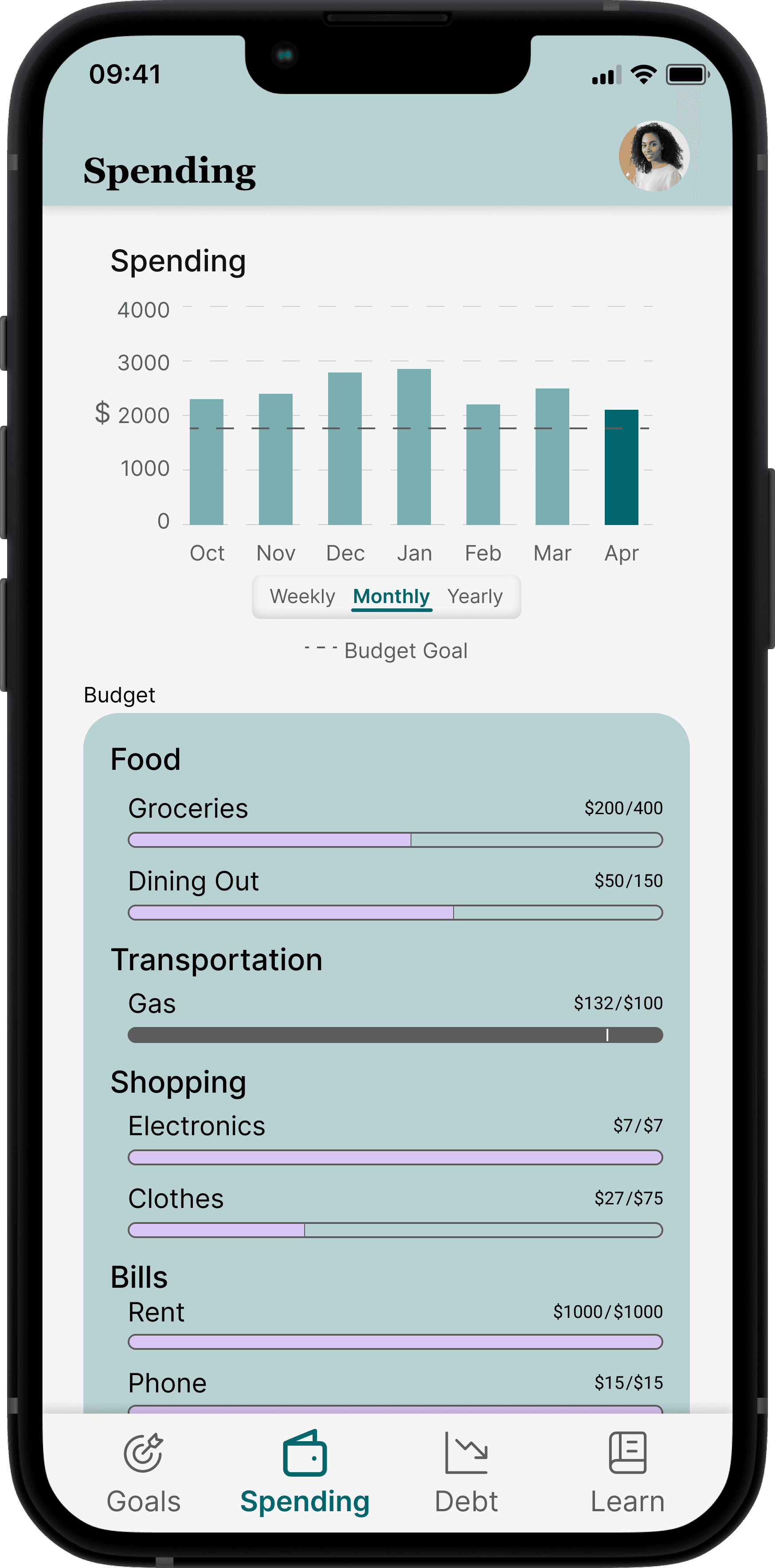

High-Fidelity Prototype

First Iteration

Evaluation

High-Fidelity Feedback Sessions

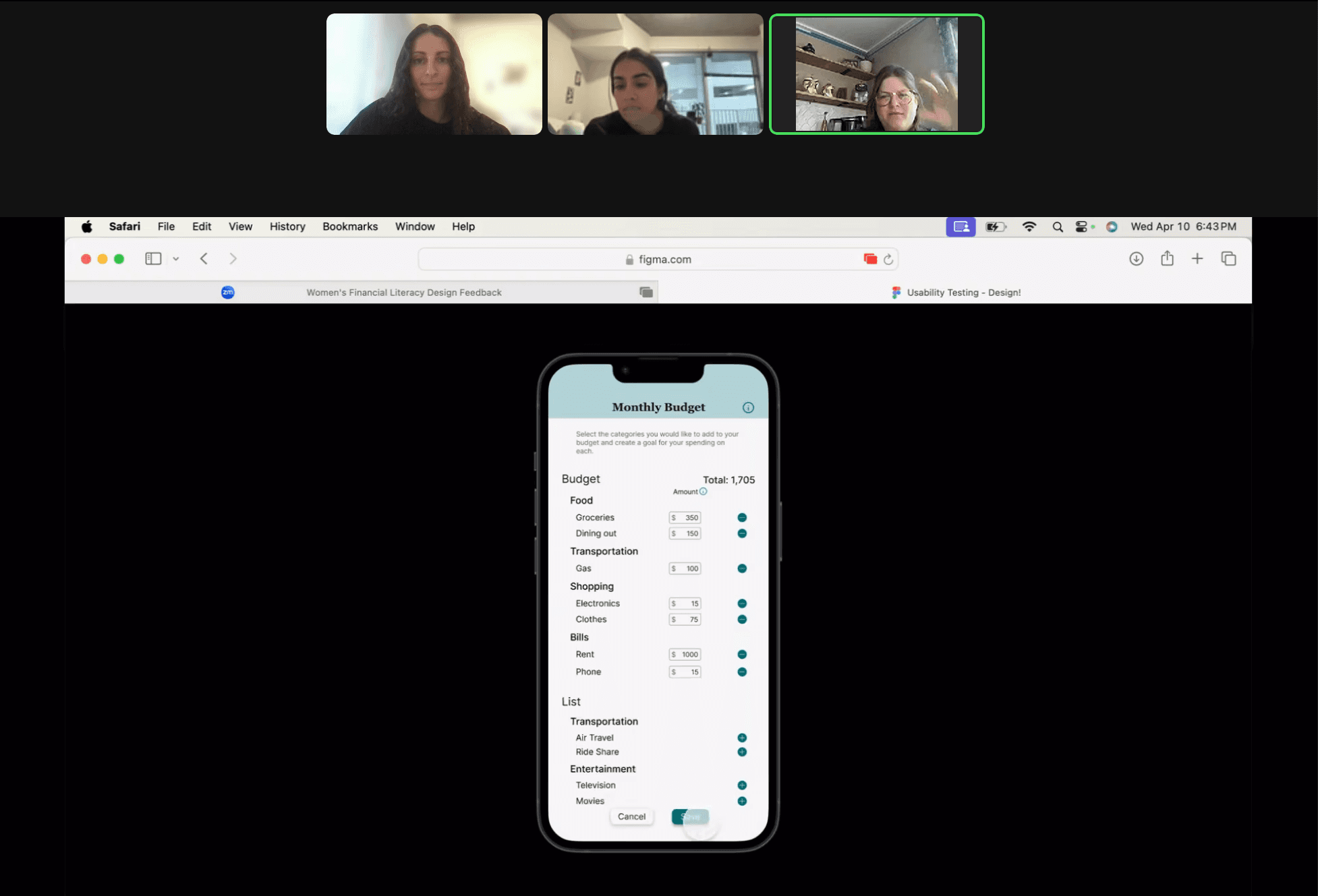

User Testing

The high-fidelity prototype was tested with 8 target users for usability, comprehension, appeal, and balance.

Protocol:

60 min long on Zoom

5 flows divided into 1-3 tasks each

Follow-up questions for each task, including difficulty ratings

Wrap-up questions with free-explore time

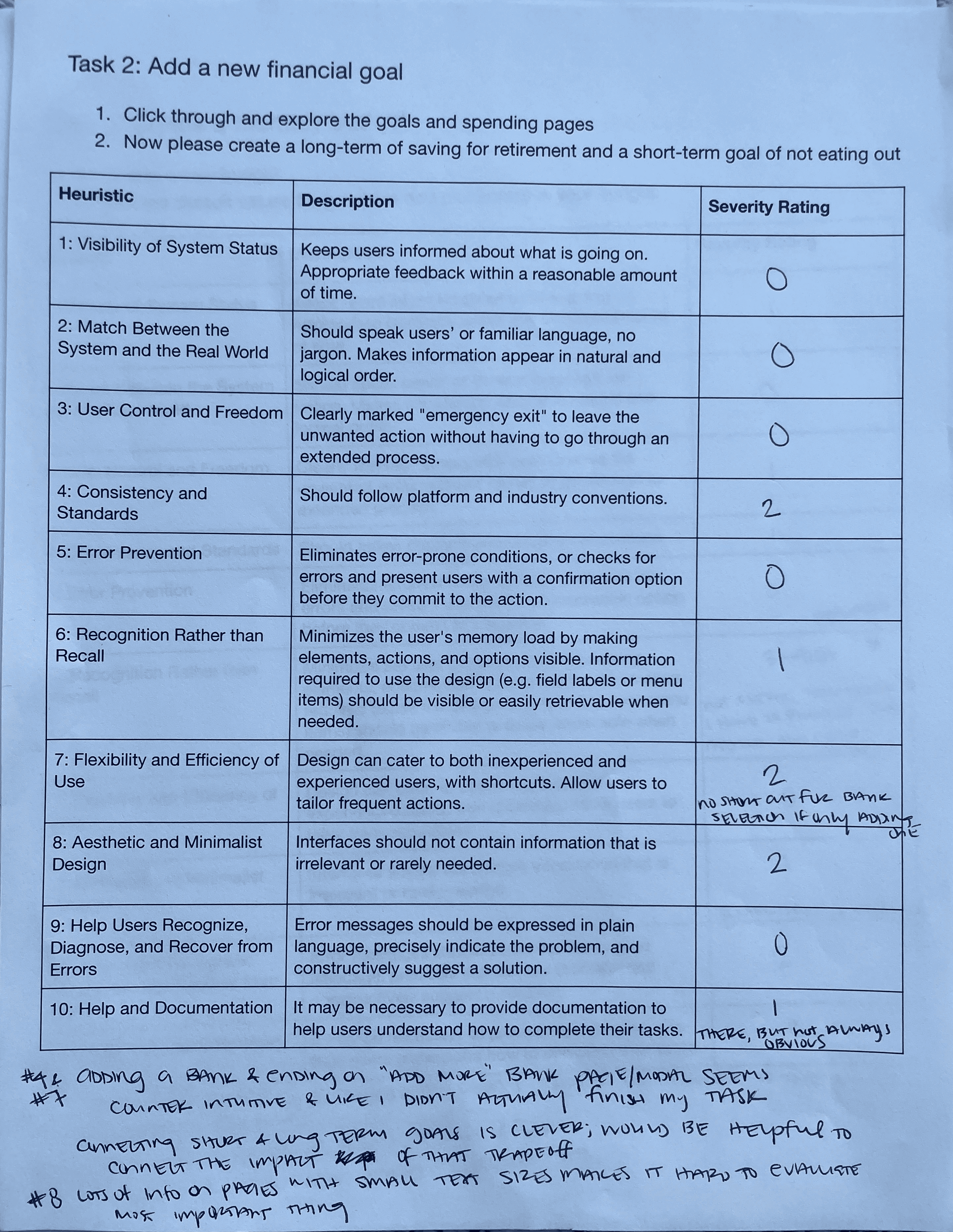

Heuristic Evaluations

Our 4 evaluators were asked to rate based off of Nielson Norman’s 10 Usability Heuristics and conventions within the financial technology industry.

Evaluators:

Sejal; UX Researcher @ Visa

Gabby; UX Designer @ Intuit

Monet; UX Designer @ Square

Sally, UX Researcher @ LendingClub

Analysis

We analyzed our findings by compiling the feedback into averages.

User Testing Average Difficulty Self-Reported

Onboarding: 1.125 (very easy)

Goal Setting & Tracking: 1.36 (very easy)

Budgeting &Tracking: 1.31 (very easy)

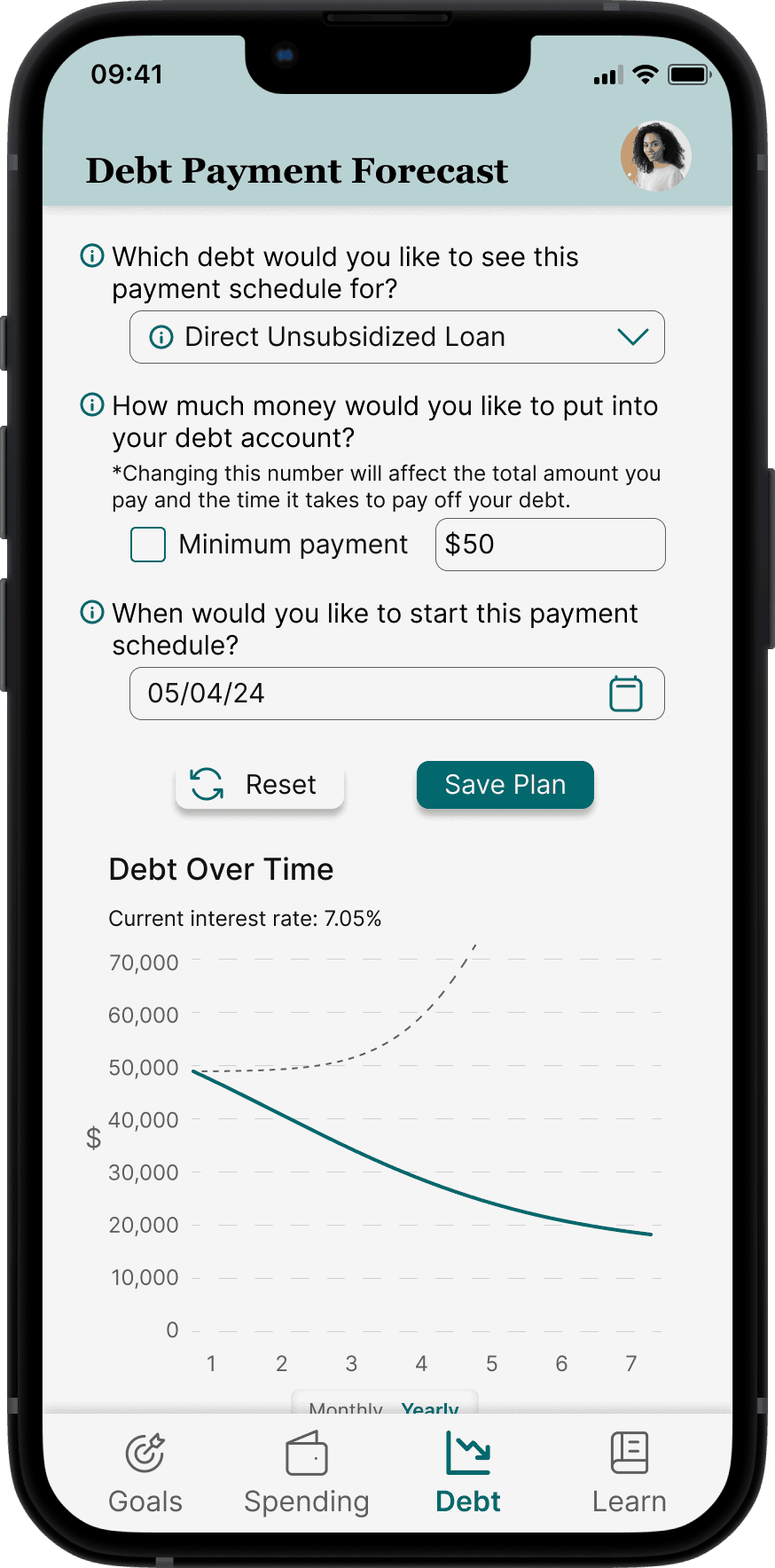

Debt Payoff Planning: 1.81 (fairly easy)

Daily Learning: 1.25 (very easy)

Heuristic Evaluation Ratings

Visibility of System Status

Match Between System & Real World

User Control & Freedom

Consistency & Standards

Error Prevention

Recognition Rather than Recall

Flexibility & Efficiency of Use

Aesthetic & Minimalist Design

Help Users with Errors

Help & Documentation

Key Insights

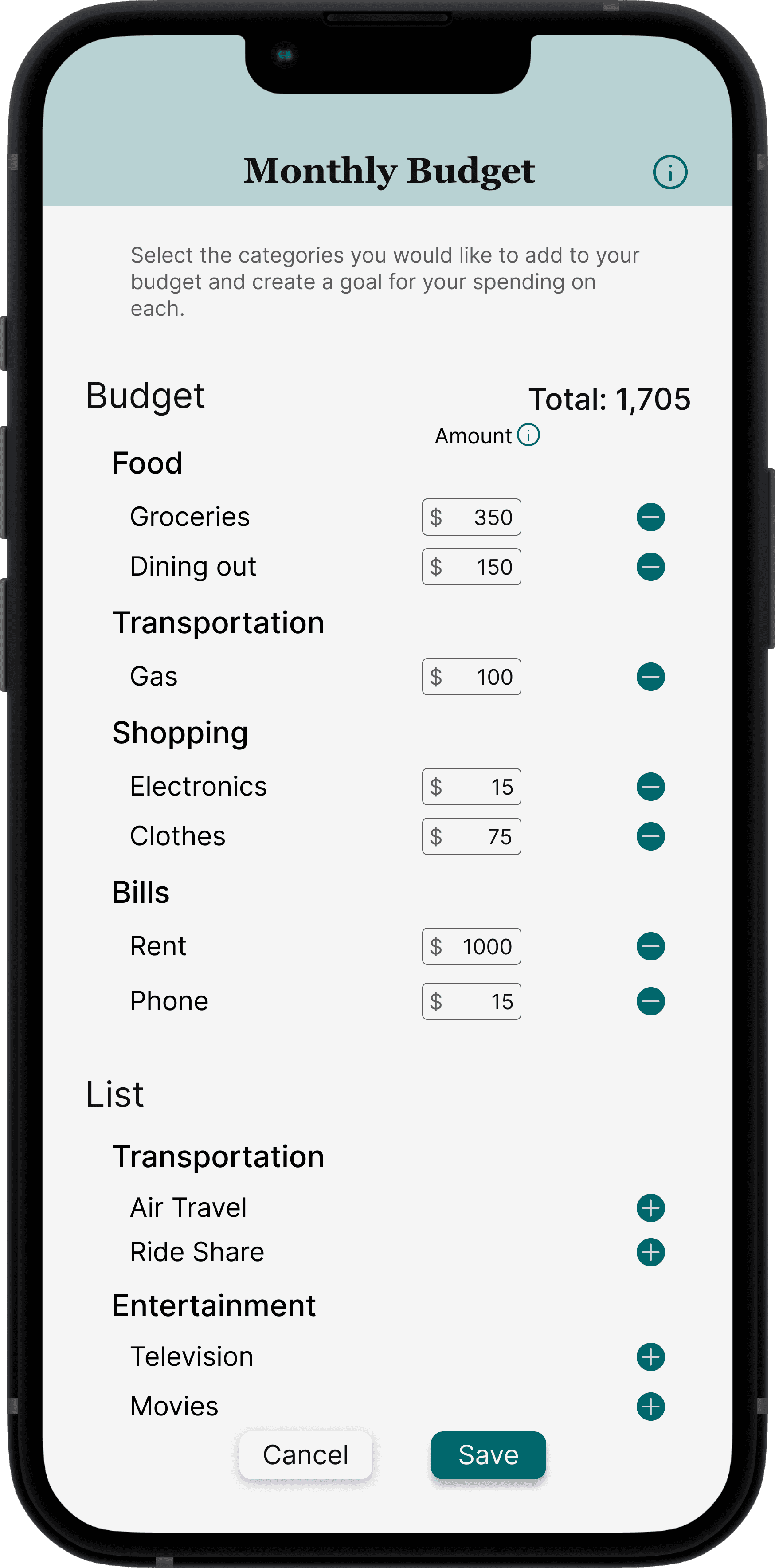

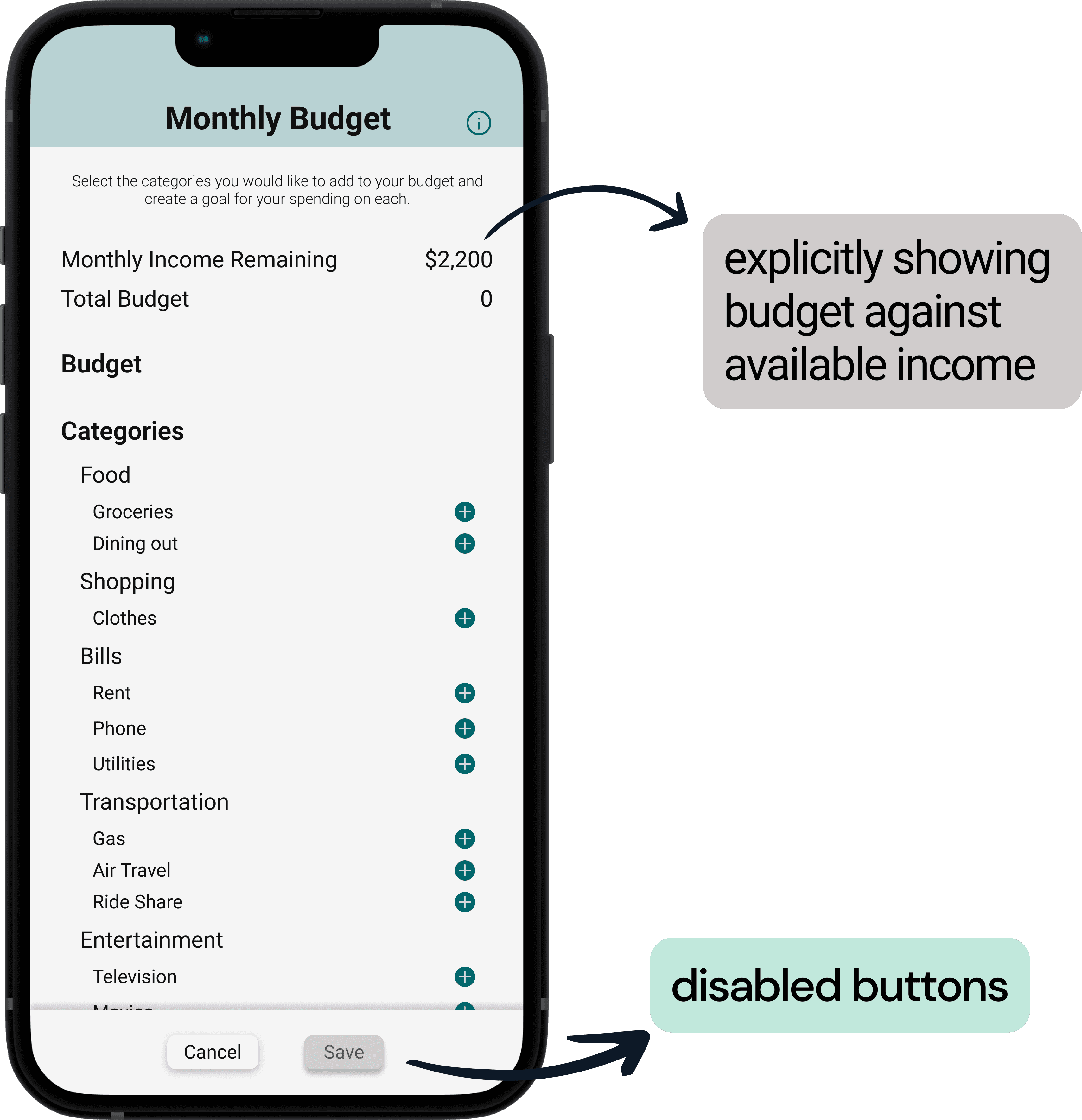

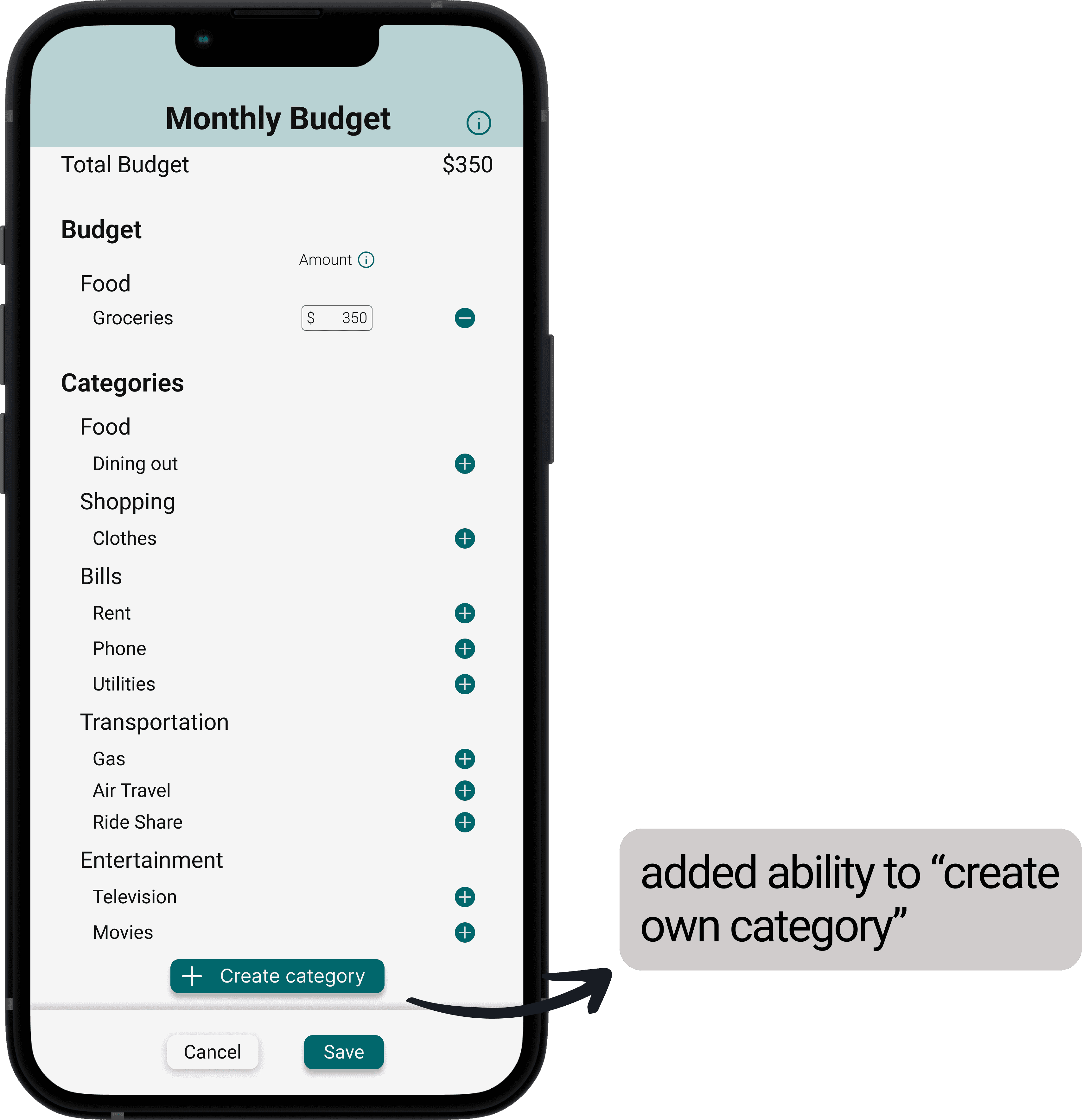

Customizability

Participants wished for more options in budgeting and goal tracking

Preferences

Users favored different functions of the product

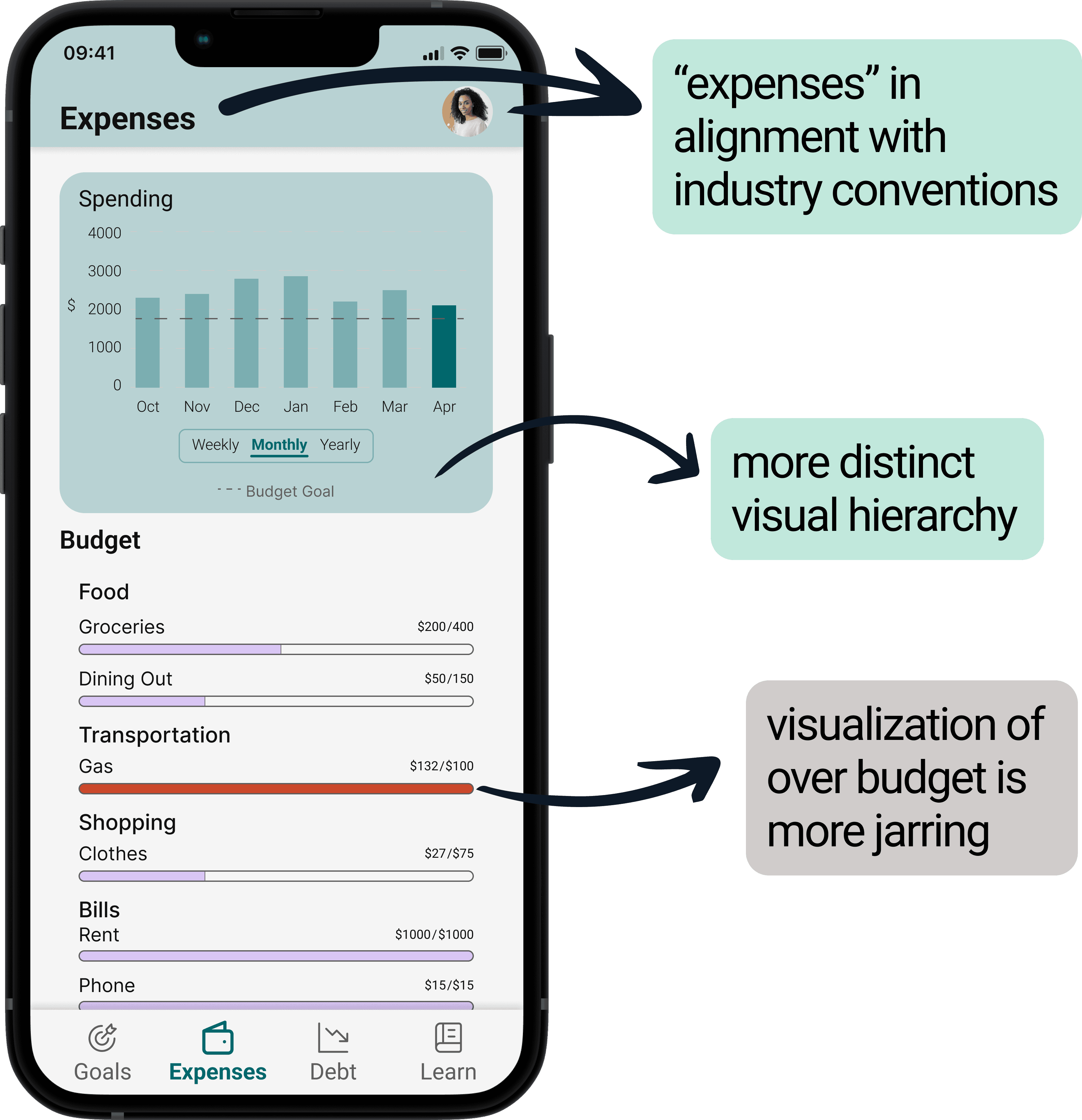

Consistency & Standards

Users felt some designs did not meet industry standards

Visibility of System Status

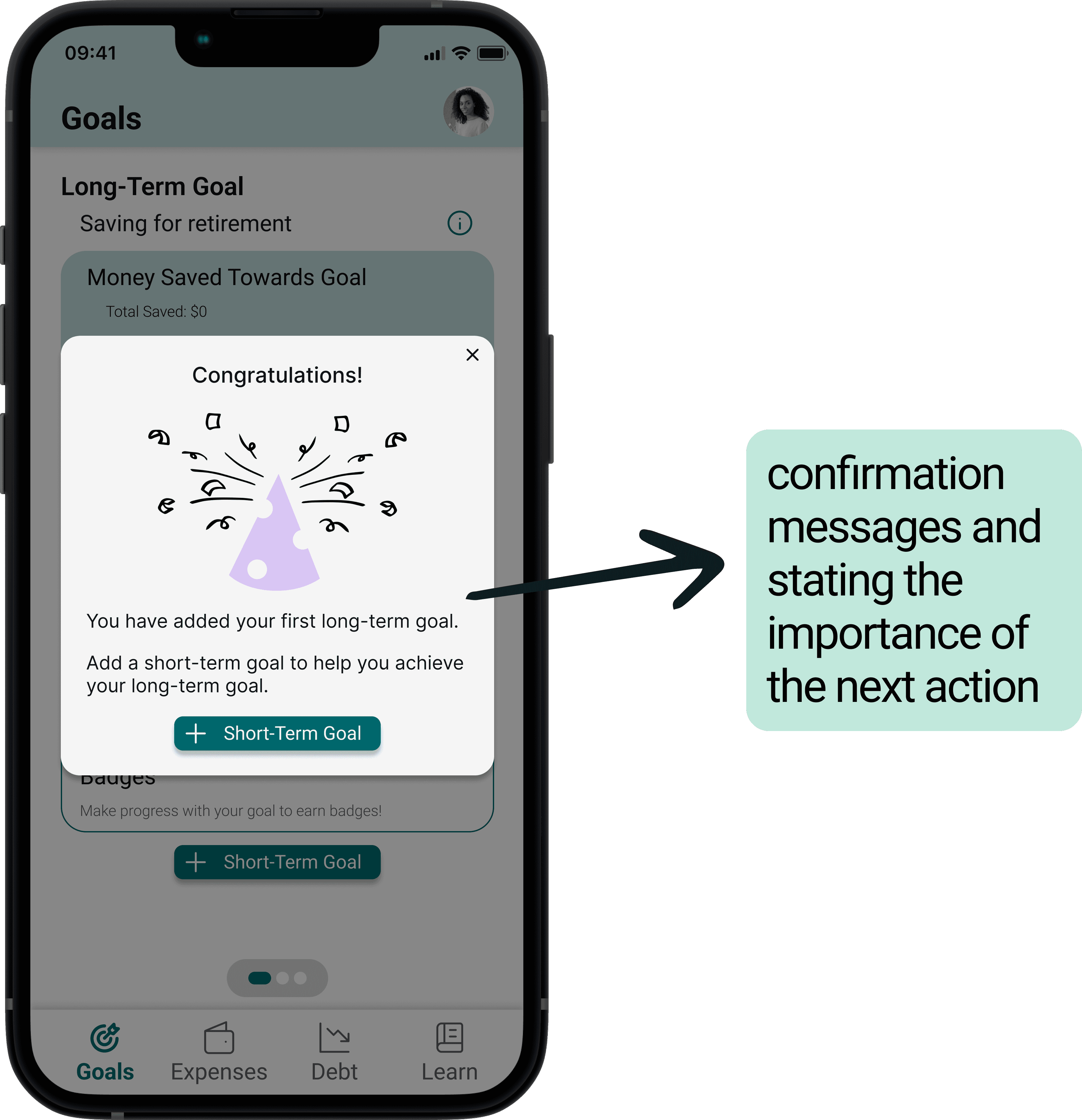

Some areas lacked adequate user information

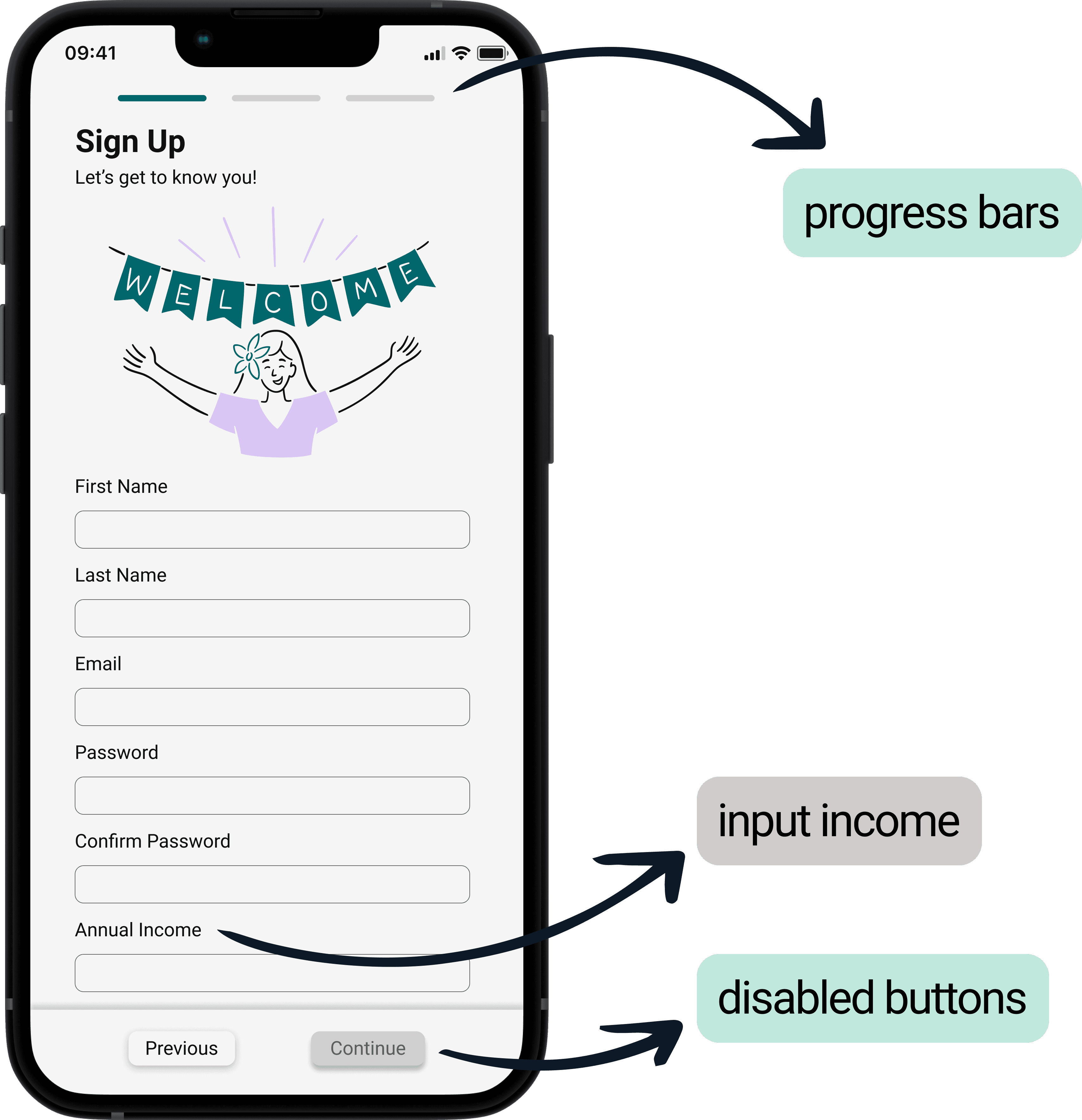

Prototype Iterations

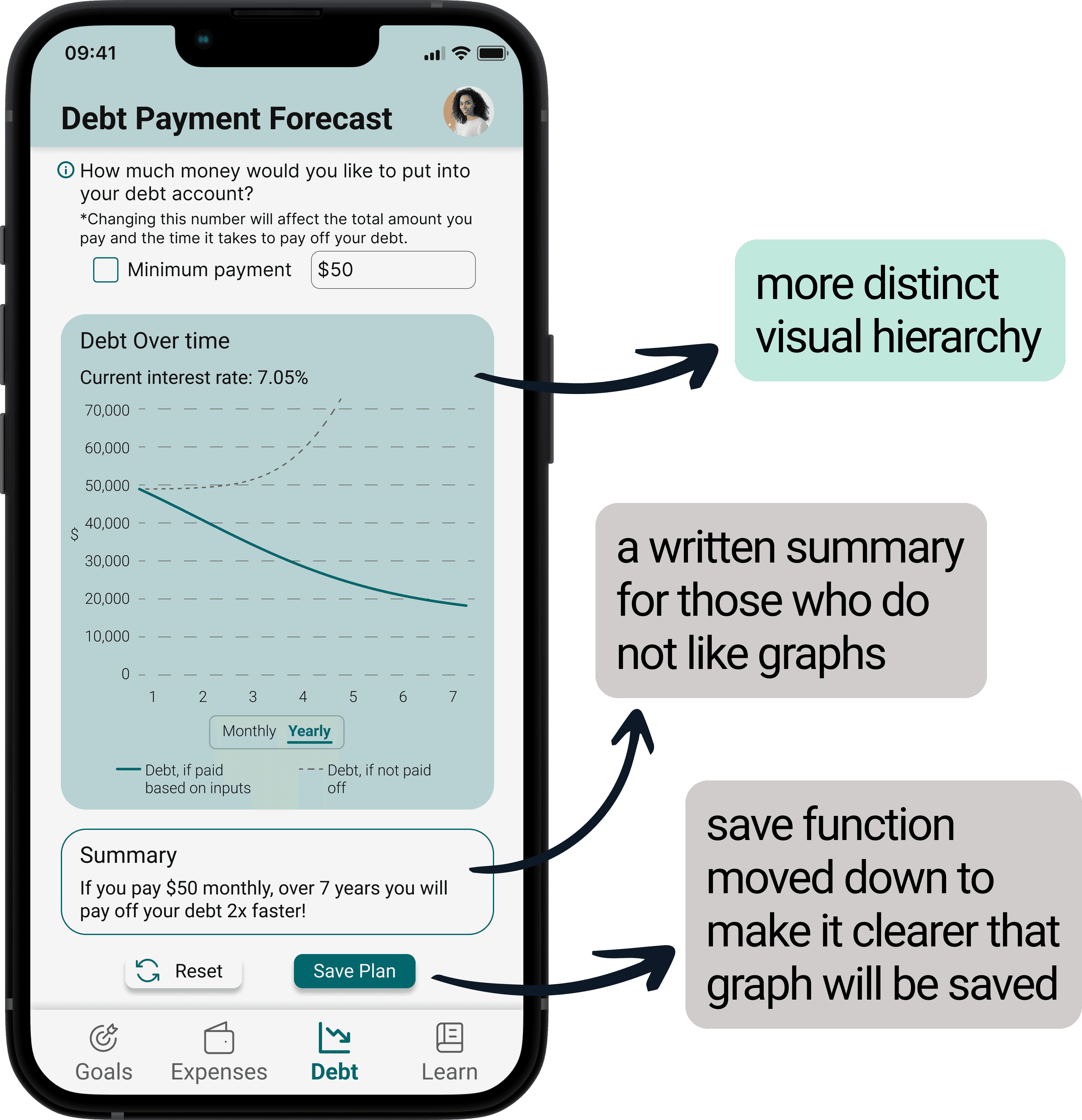

Changes made based on user feedback

Changes made based on expert evaluators

Before

After

Onboarding

Goals

Expenses

Debt

Next Steps

Homepage

Creating a homepage that will show highlights of positive change and habits with areas of improvement.

Balance

Creating balance within the application between having engaging, fun content and being a trustworthy source.

Longitudinal Study

Conducting a longitudinal study to examine retention factors and improvement in knowledge, confidence, and action long term.

Reflection

Prioritize Sampling a Diverse Set of Users Early

Engaging a diverse user group from the start can provide broad insights and helped create a more inclusive product. Initially, we used convenience sampling, but expanding our participant pool led to critical feedback and a pivotal design change.

Incorporate Expert Feedback Early On

Getting expert input earlier on would have improved our design's quality and helped avoid common pitfalls sooner.

Trust the Process

Following a structured UX process and listening to advice from our advisors, with patience for each stage, led to a more refined and user-centered product.